Tesla Upgraded to ‘Outperform’ by Daiwa Capital

In less than 24 hours, Tesla stock on Friday rallied more than $100 USD from a six-month low of $700 USD per share — reports Yahoo Finance.

On Thursday, the electric automaker’s shares dropped as much as 8.3% in intraday trading amid a broad-market selloff instigated by Russia’s invasion of Ukraine.

Daiwa Capital analyst Jairam Nathan has upgraded Tesla to ‘outperform’ status, after maintaining a neutral stance on the stock since July 2020. The electric vehicle (EV) pioneer’s stock is extending its big bounce, ushered along by Nathan saying now is the time to start buying Tesla again.

Nathan noted that renewed supply chain concerns from the building tension in Europe and rising oil prices will weigh on Tesla’s more combustion engine-focused competitors.

“Tesla’s ability to export out of cost-efficient China and history of better managing chip shortages in 2021 could strengthen its competitive position under the current Russia/Ukraine situation,” Nathan wrote in a note to clients. “At the same time, higher oil prices and potential scenario of fuel shortages, especially in Europe, could accelerate the shift to EVs.”

In the current landscape, Nathan believes Tesla is “best positioned” to satisfy the higher EV demand he sees coming as a result of soaring gas prices, especially given the automaker’s growing capacity in China and the U.S.

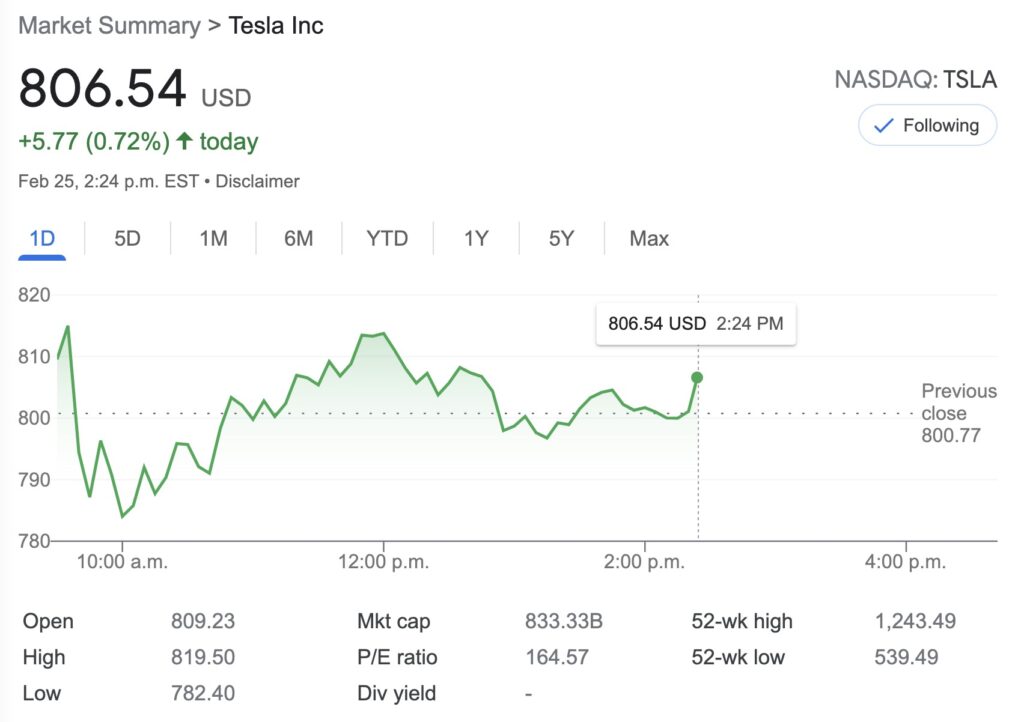

The Daiwa analyst did cut his stock price target for Tesla down from $980 to $900, but the new target still forecasts a 12.4% increase from Thursday’s closing price of $800.77. Other market analysts currently have price targets of up to $1,500 per share for Tesla stock.

Tesla’s stock has plunged 28.3% over the past three months, in a tumble that started when the company’s CEO, Elon Musk, embarked on a share liquidation spree to pay off a $13.8 billion USD tax bill.

The company’s stock is on the path to recovery, and at the time of writing is trading at $806.54 per share (up 0.72% in the day).