Tesla Gets Earnings Estimate Price Increase by Goldman Sachs

Photo: MarketWatch

While Tesla shares have yet to bounce back from all-time highs earlier this year, some investment firms are still confident the company could grow following a record-breaking second quarter.

Tesla’s (TSLA) stock is down 5.3 percent on the year, despite the fact that the S&P 500 – which the company is a part of – is sitting on a 16 percent gain, according to Barron’s. Goldman Sachs analyst Mark Delaney still remains skeptically optimistic about the company’s shares, however, even increasing his earnings expectations from $0.84 to $0.94.

In addition to increasing his earnings expectations, Delaney upheld a Buy rating on the stock, including a 12-month price target of $860.

TSLA Touches $900 Per Share, Reaching New All-Time High Ahead of Q4 Earnings https://t.co/FvklPOgHVv

— TeslaNorth.com (@RealTeslaNorth) January 25, 2021

The update comes just a few weeks before Tesla will report its second-quarter earnings, set for July 26, for which J.P. Morgan also raised earnings estimates, raising the estimate from $0.86 to $0.91 after Tesla announced it had delivered over 200,000 vehicles.

Delaney cited updates to Tesla’s Model Y as a major driver of earnings, with Tesla also released a new Model Y variant in China last week which is 20 percent cheaper and has a “standard range.”

China, being the world’s largest auto market, remains an important one for Tesla as the trajectory of their shares change over time.

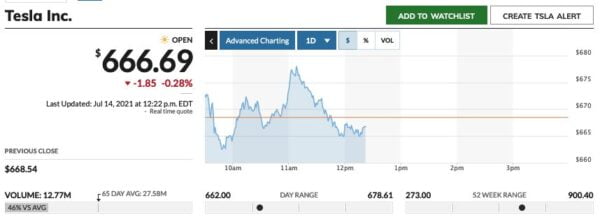

At the time of writing, Tesla’s (TSLA) shares were trading at $666.69, down 1.85 percent on the day.