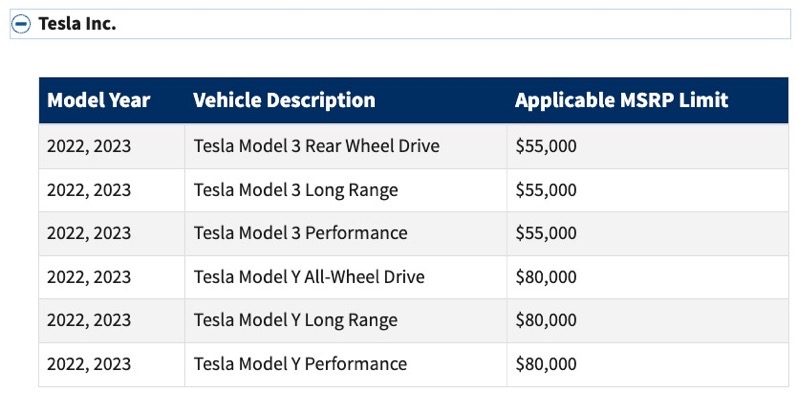

All Tesla Model Y Trims Now Qualify for the EV Tax Credit, After Feds Face Pushback

The U.S. Treasury Department has adjusted how it categorizes vehicles subject to price caps for the Inflation Reduction Act’s electric vehicle (EV) tax credit.

The Treasury plans to use consumer-facing EPA Fuel Economy Labeling to distinguish between sedans, SUVs, pickups and vans, rather than using the corporate average fuel economy standards, according to Automotive News.

The shift raised the cap on Tesla’s Model Y units to $80,000 across the board, making all Tesla Model Y units qualify for the tax credit, rather than just the 7-seater variant. The change also adds eligibility for a number of crossover vehicles beyond Tesla’s lineup, including the Mustang Mach-E.

“This change will allow crossover vehicles that share similar features to be treated consistently,” Treasury wrote on Friday. “It will also align vehicle classifications under the clean vehicle credit with the classification displayed on the vehicle label and on the consumer-facing website FuelEconomy.gov.”

Even customers who have purchased and received delivery on or after January 1 can qualify for the change, so long as they satisfy other requirements of the credit.

Previously, the 7-seater Model Y units were the only variants of the SUV that were categorized in the $80,000 price limit, with the tax credit rules placing the Model Y 5-seaters in the $55,000 price limit — officially omitting them from eligibility due to their price tags. What does this change mean? Tesla could increase prices now that it knows all Model Y trims qualify for the tax credit.

Now, a fully-loaded Model Y Performance with 5 seats, red paint upgrade, tow hitch, white interior and Full-Self Driving, at the cost of $75,990 USD, now qualifies for the $7,500 tax credit, as it falls under the $80,000 price limit.