Tesla Q1 2024 Earnings See Decline Amidst Global Challenges

Tesla has announced a decrease in its net income for the first quarter of 2024, recording $1.1 billion in GAAP net income, down from previous quarters.

The company faced several adversities including the Red Sea conflict and an arson attack at its Gigafactory Berlin, alongside the initial phase of the updated Model 3 production at its Fremont facility.

Despite these challenges, Tesla’s commitment to expansion and innovation remains steadfast with $2.8 billion in capital expenditures aimed at enhancing AI infrastructure, production capacity, and its Supercharger and service networks.

Tesla also reported a significant reduction in its free cash flow, which turned negative by $2.5 billion, primarily due to substantial investments in AI infrastructure amounting to $1.0 billion within the quarter. Additionally, the company noted a $2.2 billion decrease in its cash reserves, now totaling $26.9 billion.

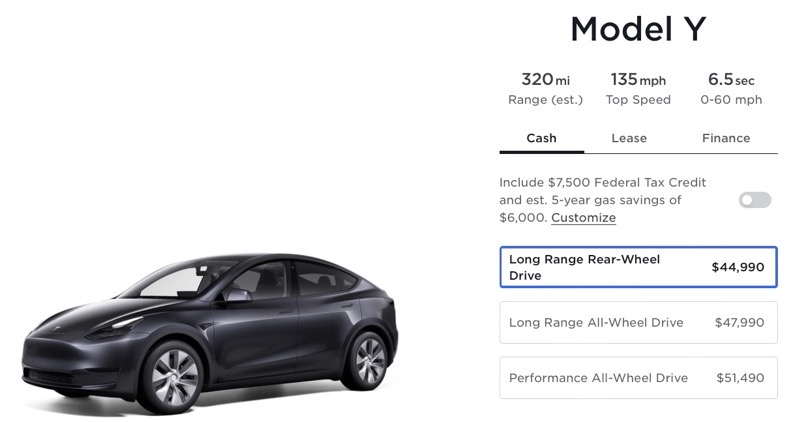

In terms of sales, global electric vehicle adoption continues to face pressure, particularly outside China. This has led Tesla to ramp up promotional efforts, including attractive leasing terms and reduced pricing for its Full Self-Driving subscription, now at $99 per month, to bolster consumer interest and support ongoing growth.

Tesla’s operational report highlighted a record 4.1 GWh of energy storage deployment, an achievement that underscores the company’s leading role in the energy sector. Nonetheless, automotive revenues have decreased by 13% year-over-year, with total revenues for Q1 settling at $21.3 billion, marking a 9% decrease from the previous year.

But here’s where it gets interesting. Tesla appears to be accelerating its efforts for its next-gen vehicle and Robotaxi. Yup, Reuters is fake news as Elon Musk previously confirmed.

“We have updated our future vehicle line-up to accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025,” said Tesla.

“These new vehicles, including more affordable models, will utilize aspects of the next generation platform as well as aspects of our current platforms, and will be able to be produced on the same manufacturing lines as our current vehicle line-up,” noted the company.

“This update may result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times. This would help us fully utilize our current expected maximum capacity of close to three million vehicles, enabling more than 50% growth over 2023 production before investing in new manufacturing lines,” details the slide deck.

“Our purpose-built robotaxi product will continue to pursue a revolutionary “unboxed” manufacturing strategy,” says Tesla.