What Tesla Vehicles are Eligible for $7,500 Federal Tax Credit? Here They Are [LIST]

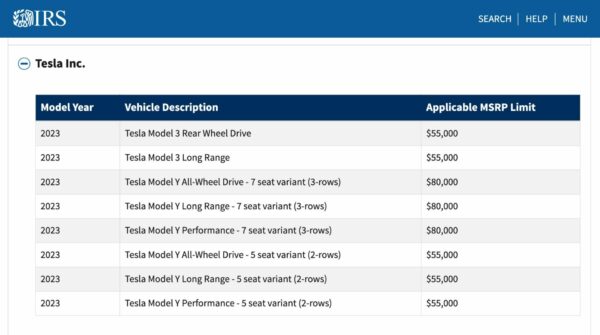

Photo: IRS

The Internal Revenue Service has shared vehicle eligibility information for the coming $7,500 USD federal tax credit for electric vehicles (EVs) on its website, including a list of Tesla’s vehicles and their applicable pricing limits.

On the web page, the IRS notes that appear in the list “do not automatically qualify,” and many of the Tesla vehicles on the site are not eligible.

The credit, which is set to become active in 2023 following the Inflation Reduction Act, features two separate price limits — pricing for vans, SUVs and pickups must be $80,000 or below, while pricing for cars and other vehicles must be $55,000 or below.

Tesla’s 7-seater, 3-row Model Y units qualify with the IRS in the upper category with a limit of $80,000 or below, while the 5-seater, 2-row variants fall into the $55,000 eligibility category — meaning the latter will not be eligible, since all trims in the 2-row variety are priced beyond $55,000.

The above was also explained in a simple chart shared by @Mathias Føns:

Tesla Vehicles Eligible for $7,500 IRA Credit pic.twitter.com/YcWWziGOiR

— Mathias Føns (@FonsDK) December 29, 2022

As a result, if Tesla’s current pricing models are to remain as is, only the Model Y Long Range 7-seater will be eligible for the $7,500 tax credit out of the entire set of Model Y trims.

The Tesla Model 3 rear-wheel-drive variant will also be eligible, falling under the IRS’s $55,000 limit.

Competitors such as Ford are facing a similar problem as their Mustang Mach-E does not qualify, since the latter is capped at $55,000 USD.

In order to get the $7,500 IRA credit, specific income requirements are needed.

Tesla recently increased its own Model 3 and Y discount on U.S. deliveries to $7,500 for all purchases made by the end of December, as part of a Q4 last-minute push. It seems it’s a better deal to get that Tesla discount now especially for prospective Model Y owners.