U.S. House Passes Climate Bill Containing $7,500 EV Tax Credits

The U.S. House of Representatives on Friday passed the Inflation Reduction Act (IRA), the largest climate bill ever passed in the country. It includes $369 billion USD in climate-related funding, part of which will cover tax credits of up to $7,500 USD for new and used electric vehicle (EV) purchases.

The IRA cleared the U.S. Senate earlier this week, and now awaits President Joe Biden’s signature. President Biden is expected to sign the bill into law in the coming days, upon which its implications for EV tax credits will take effect immediately.

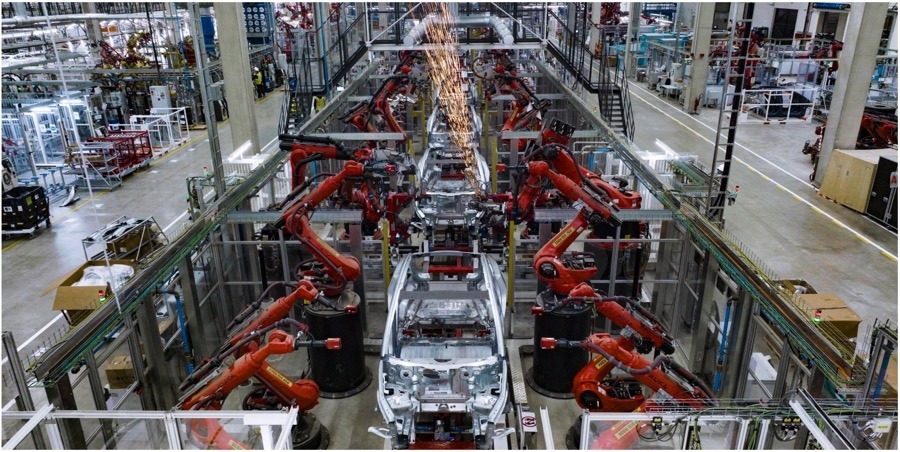

Unfortunately, some automakers aren’t exactly happy with the bill since it revamps the eligibility requirements for EV tax credits and introduces some pretty close-fisted price and income restrictions.

As raw material and production costs continue to soar, it’ll become harder and harder for automakers to slide in under the price threshold for tax credits. Top carmakers previously urged Congress to raise the price cap for tax credits, but to no avail.

EV customers can sign “binding purchase agreements” with automakers before President Biden signs the IRA to maintain eligibility under the previous tax credit criteria.

Under the IRA, eligibility for tax credits will also be contingent upon the percentage of a vehicle’s battery components that are sourced responsibly. The government is yet to iron out the specifics of this aspect of the bill, among others.

On the bright side, the climate bill extends tax credits to used vehicles and also eliminates the per-manufacturer cap of 200,000 credit-eligible EV sales. The latter is good news for companies like Tesla and Toyota, which had already hit that ceiling.

In addition to EV tax credits, the IRA also offers incentives for domestic green energy production, installation, and research, along with home efficiency credits.