Tesla Price Target Raised to $900 by BofA Securities

Photo: MarketWatch

As Tesla prepares for its upcoming Q3 earnings report tomorrow, the company is seeing a number of analysts and firms bullish on what’s expected, following record Q3 deliveries.

B. of A. Securities raised its price target on Tesla from $800 to $900 on Tuesday, according to MarketWatch. The news comes ahead of Tesla’s Q3 earnings report meeting set for Wednesday, and following an impressive 241,300 units delivered in Q3 2021 – which has many analysts feeling extra bullish.

B. of A. reported that Tesla outperformed the firm’s expectations with a “slight premium,” largely pointing to the company’s history of gains and capital raises as reasons for the price target increase.

Tesla’s Third-Largest Single Shareholder to Buy Over 1 Million More Shares in January https://t.co/rTULD6JrEc

— TeslaNorth.com (@RealTeslaNorth) October 15, 2021

In a note, B. of A.’s analysts cited Tesla’s “track record of growth, consistent capital raises, and overall investor hype” as part of the reason it raised the company’s price target.

The company has seen roughly 23 percent in gains so far this year, with gains nearing 20 percent for the S&P 500 index, which Tesla entered last December.

Other firms have also reported bullish thoughts on Tesla’s growth ahead of the meeting, including Canaccord Genuity who raised their Tesla price target to $940 and Wedbush, who says Tesla shares will be “pushed higher” despite the near-term chip shortage.

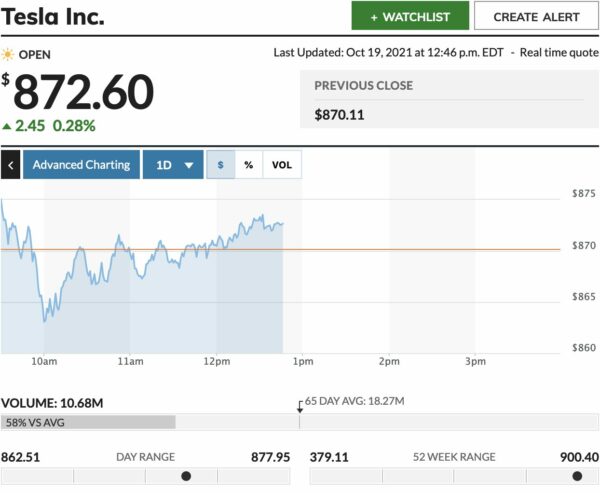

At the time of writing on Tuesday, Tesla’s (TSLA) shares were trading at $872.60 (+2.45), up 0.28 percent from the market’s open.