KGI Securities Starts Covering Tesla, Gives ‘Outperform Rating’ and $855 Price Target

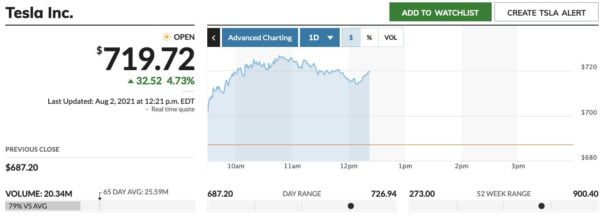

Photo: MarketWatch

Tesla has remained dominant in the world of zero-emissions vehicles, and while its stock hasn’t reached its previous all-time high of $900 per share, it certainly has analysts paying attention.

Street Insider reported on Monday that Taiwan-based KGI Securities will start covering Tesla, with analyst Jennifer Liang now covering the company. The firm’s first report on Tesla comes in the form of an Outperform rating and an $855 USD price target (via @Mighty Tesla).

Liang also went on to emphasize Tesla’s technological dominance in the electric vehicle (EV) space, saying she expects Tesla to “maintain its leading position in the global EV space for at least the next 3-5 years” – though the firm sees legacy automakers seizing market potential opportunities and improving their approaches to EVs in the long-term.

NEWS: KGI Securities starts coverage of $TSLA with an Outperform rating and a PT of $855; expects the company "to maintain its leading position in the global EV space for at least the next 3-5 years." https://t.co/6p6w4qCNcI

— Mighty T Ξ S L A (@MightyTesla) August 2, 2021

In the note, Liang wrote, “Tesla demonstrates technological superiority and continued dedication to enhancing its EV offerings on all fronts, including software and hardware, namely: (1) advanced Autopilot and full self-driving (FSD) features; (2) the ability for over-the-air (OTA) updates; (3) in-house design of software and electronic architecture, enabling the firm to introduce innovations faster than rivals; (4) a self-developed new 4680 battery cell architecture and unibody castings; and (5) a wide Supercharger network build-up worldwide.”

KGI Securities is the former home of well-known Apple analyst Ming-Chi Kuo, who frequently and accurately predicts the iPhone maker’s product timeline, based on supply chain sources.

At the time of writing, Tesla shares (TSLA) are selling at a price of $719.72 (32.52+), up 4.73 percent from Monday at market open.