Tesla Short Sellers Have All But Disappeared for Now, Report Says

It’s been a wild ride for Tesla’s (TSLA) stock the past few years, and new questions have arisen as to the great vanishing of the company’s many short-sellers.

Tesla, now a few years separated from its status as a classic controversial stock, has put many of its bears to sleep, its short-sellers have all but vanished, and its bulls are still comfortably holding on – even despite recent losses to the company’s share prices, reports Barron’s.

In Wall Street terms, “controversy” can be measured using stock ratings. From Wall Street’s analysts today, Tesla has 15 buy ratings, 14 hold ratings, and 12 sells, as noted by Bloomberg. The minimal gap between buys and sells is considered highly abnormal, with Buys outnumbering Sells nearly 10 to 1 in the Dow Jones Industrial Average.

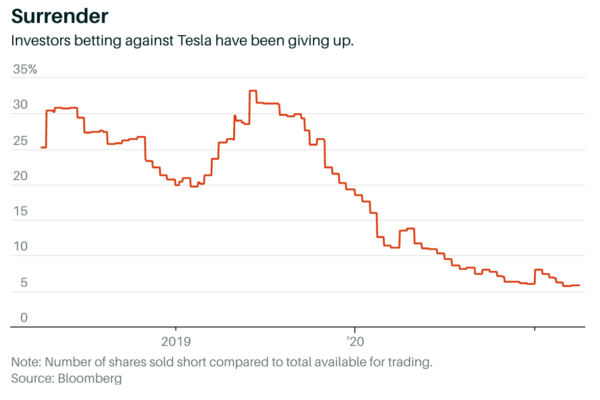

The chart above from Bloomberg shows the number of shares sold short compared to the total available for trading have fallen over the past couple of years. Three years ago the Tesla short-interest ratio was roughly 25%, compared to today at roughly 6%.

Bears don't have much fight anymore, despite a nice dip in the share price, and the short sellers have all but surrendered. https://t.co/71NZHhKvim

— Barron's (@barronsonline) April 2, 2021

For short-sellers, however, now would seem like the time to buy, so it leaves the onlooker curious as to where exactly they’ve all gone.

Ahead of its Q4 2020 earnings meeting in January, Tesla’s shares briefly touched $900 per share, before dipping quite a bit and then beginning to recover in the months since.

On Good Friday, Tesla announced another record quarter, revealing Q1 2021 numbers, with production and vehicle deliveries surpassing its previous quarter, and beating Wall Street estimates.