Tesla Q1 2023: What You Need to Know

Tesla today announced its Q1 2023 earnings and revenues of $23.3 billion for Q1 2023, up 24% year-over-year, while net income was at $2.5 billion, thanks to its record production and deliveries.

Tesla sees the current macroeconomic environment as a unique growth opportunity, leveraging its cost leadership position. The company’s primary focus is to increase production, invest in vehicle autonomy and software, and maintain growth investments.

The company’s pricing strategy takes into account the potential lifetime value of its vehicles, including benefits from autonomy, supercharging, connectivity, and service. Product pricing will adapt to various factors, either increasing or decreasing accordingly.

Despite Q1 price reductions on many vehicle models, Tesla’s operating margins decreased at a manageable rate. The company anticipates ongoing cost reductions, improved production efficiency at new factories, and lower logistics costs. It remains focused on operating leverage as it scales.

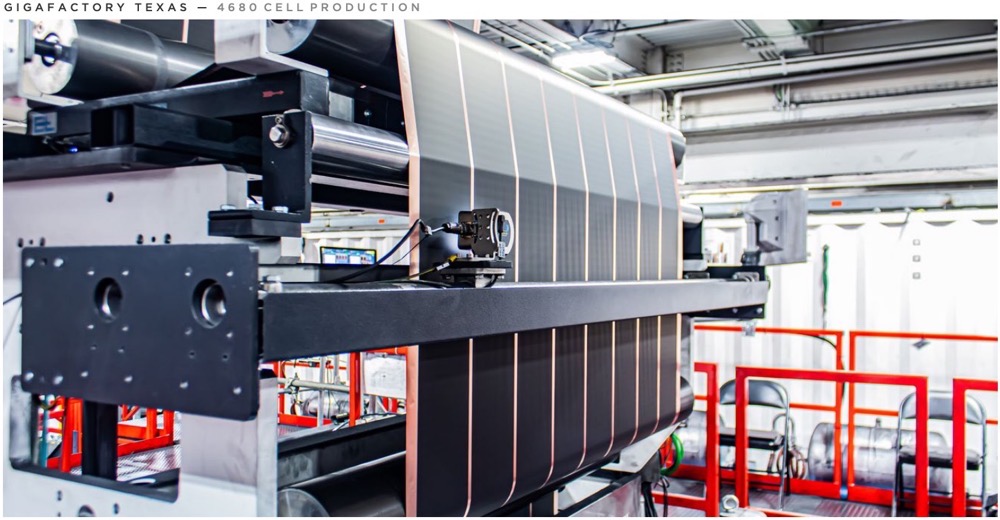

Tesla is rapidly expanding its energy storage production capacity at the Lathrop Megafactory and recently announced a new Megafactory in Shanghai. The company’s product roadmap includes the Cybertruck, next-generation vehicle platform, autonomy, and AI-enabled products. A strong balance sheet and net income support continued capital investments for future growth.

Q1 2023 highlights:

- Energy storage deployments increased 360% YoY to 3.9 GWh due to the ongoing Megafactory ramp.

- Solar deployments increased 40% YoY to 67 MW but declined sequentially due to volatile weather and supply chain challenges.

- Record-high revenue and gross profit were achieved in the Services and Other division, with strong YoY growth in used vehicle sales and supercharging.

- Full Self-Driving (FSD) beta miles driven: over 150 million miles to date and counting

- Model Y best-selling car in the U.S. (excluding pickups)

- Model Y best-selling car in Europe

- Cybertruck alpha versions being made; factory tooling on track

- Telsa locations: 1000

- Mobile service fleet: 1,692

- Supercharger stations: 4,947

- Supercharger connectors: 45,169

Tesla’s outlook:

- Align production growth with its 50% compound annual growth rate target, expecting to produce around 1.8 million cars in 2023.

- Maintain sufficient liquidity to fund product roadmap, capacity expansion plans, and other expenses.

- Ensure a strong balance sheet during uncertain periods while focusing on hardware and software-related profits.

- Begin Cybertruck production at Gigafactory Texas later this year and make progress on the next-generation vehicle platform.

On the Q1 earnings call, Tesla CEO Elon Musk said the company feels “comfortable” with 1.8 million cars produced this year, but 2 million might be possible. He also added that a Cybertruck first delivery event will probably take place in Q3.