Tesla Investors ‘Buying the Dip’ Hit Single-Day Record High This Month

Image via WSJ

Following a rough year in the market for the technology sector, most investors have stopped buying the dip on most stocks, except for one–Tesla.

Tesla’s stock is still being purchased at its low price, while other retail investors have largely stopped buying the dip in various tech stocks, according to The Wall Street Journal.

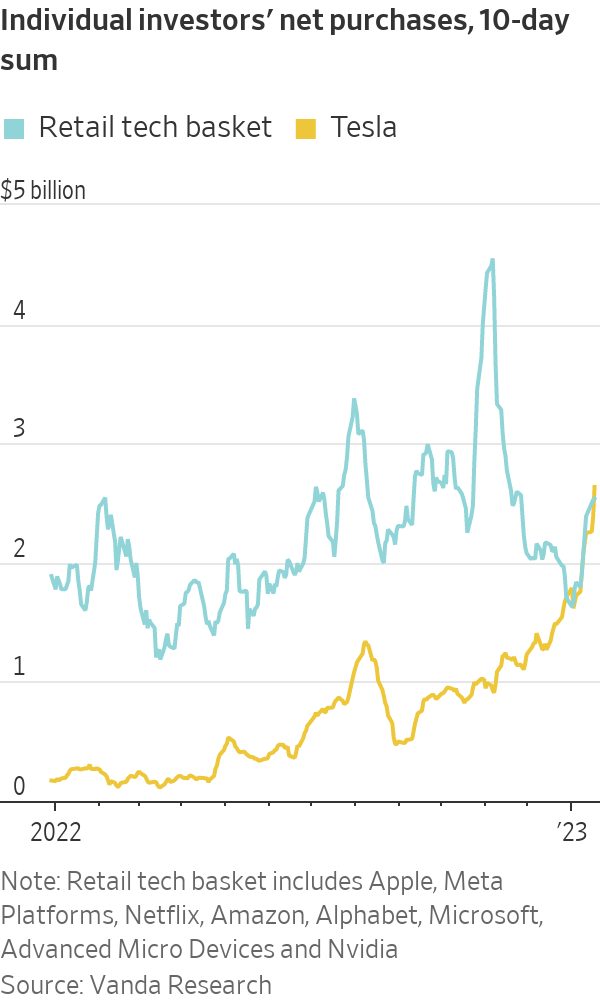

In November, investor net purchases of eight popular tech stocks peaked, before dropping off significantly through the end of the year. Since the new year began, investor purchases have increased slightly, and most tech stocks have started to rebound.

Image via WSJ

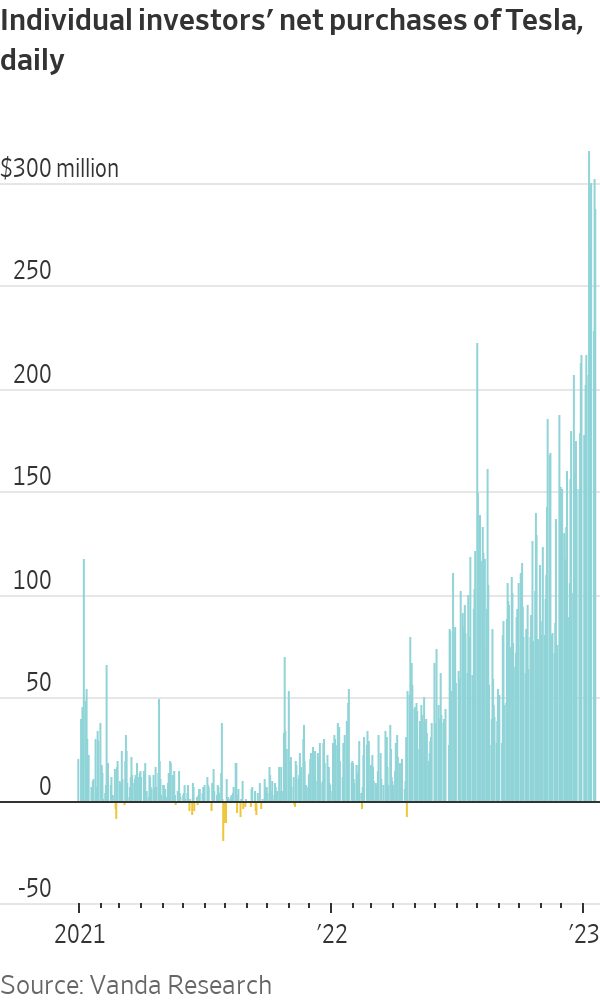

Tesla remains an outlier, having kept a steady stream of buyers through the end of 2022 buying the stock at its tumbling prices. According to Vanda Research, investors have spent more on Tesla shares in the past six months than in the five years before.

Single-day net purchases of Tesla shares also hit a record $316 million on January 10, emphasizing continued investor interest.

“As markets took a big hit, we saw retail investors shift into their favorite tech stock rather than investing across the whole sector,” Vanda analyst Lucas Mantle said about Tesla investors buying the dip. “It might be the last shoe to drop.”

Tesla will hold its fourth-quarter and year-end earnings call on January 25, and shareholders can begin asking questions leading up to the event.