Tesla Increases Model 3/Y Discount to $7,500 for U.S. Deliveries in December [Update]

After adding a $3,750 discount to Model 3 and Model Y deliveries in the U.S. until the end of December, Tesla has now doubled this amount to $7,500.

According to a screenshot from Tesla received by WaitingforTesla.com and shared with Tesla North, the electric automaker says there’s now a $7,500 price adjustment until December 31, 2022. The company’s website has yet to be updated with the discount, but should shortly.

Tesla says this new $7,500 discount is on top of the existing 10,000 free Supercharging miles promotion that goes until the end of December as well. Tesla tells customers by text message to “reply YES” if they want to take advantage of this special incentive.

Some Tesla owners have held off from taking deliveries until January 1, 2023, as that’s when a U.S. tax credit will offer $7,500. But now Tesla has matched this discount before the end of the year, as part of a year-end Q4 push.

From January to at least March, the $7,500 tax incentive is available for eligible households until the federal government release battery component guidance. The tax rebate will be applied in 2024 when applicants file their tax returns. The government announced EV tax credits this week would be delayed until March 2023, instead of taking place on January 1, 2023.

This means manufacturers like Tesla and GM can now get EV tax credits again, as previously they had passed the sales threshold of 200,000 EVs sold, as per older rules. Based on the U.S. government’s complicated battery minerals requirement, Tesla was set to get half the amount on January 1. But that has since changed with the delay of the component guidance to March.

As per Yahoo Finance:

The IRA’s rules regarding the EV tax credit require that $3,750 of the credit is only eligible if 40% of the value of the critical minerals in the battery have been “extracted or processed” in the U.S., or a country with a U.S. free-trade agreement. The Treasury has delayed guidance for this requirement until March, instead of January 1, 2023.

The other $3,750 portion of the credit is contingent on having 50% of the battery components built in North America. The IRA EV tax credit also requires that EVs are assembled in North America, along with pricing ($55,000 for cars and $80,000 for trucks, SUVs) and income requirements to meet in order to receive the credits.

Tesla is also offering other discounts for customers in China and Europe to push year-end sales.

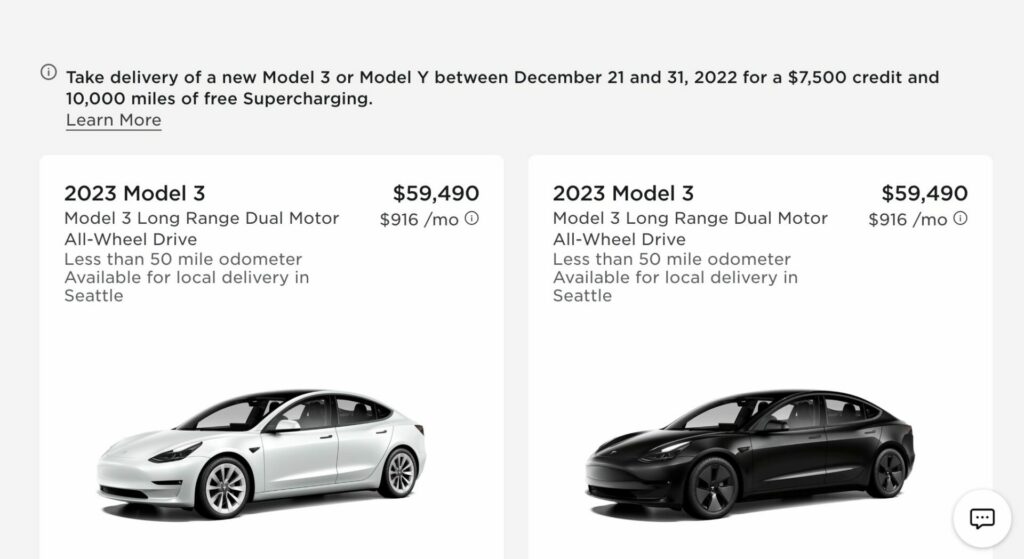

Update: Tesla has now updated its website to show the $7,500 credit–check it out below:

“Take delivery of a new Model 3 or Model Y between December 21 and 31, 2022 for a $7,500 credit and 10,000 miles of free Supercharging,” says Tesla:

Also, this credit goes beyond the USA. For Canadians, there’s a $5,000 CAD credit showing right now according to the company’s website. “Take delivery of a new Model 3 or Model Y between December 21 and 31, 2022 for a $5,000 credit and 10,000 kilometers of free Supercharging.”