Tesla Booted from S&P 500 Environmental Index, But Exxon Mobile Remains

Tesla has been removed from the S&P 500 environmental, social, and governance (ESG) index, as part of the latter’s fourth annual rebalancing on Tuesday.

The automaker was removed over what the S&P 500 ESG says was the company’s handling of claims of racial discrimination at its Fremont factory, plus NHTSA investigations into the claims of deaths related to Autopilot.

“In addition, a Media and Stakeholder Analysis, a process that seeks to identify a company’s current and potential future exposure to risks stemming from its involvement in a controversial incident, identified two separate events centered around claims of racial discrimination and poor working conditions at Tesla’s Fremont factory, as well as its handling of the NHTSA investigation after multiple deaths and injuries were linked to its autopilot vehicles,” said the index.

“Both of these events had a negative impact on the company’s S&P DJI ESG Score at the criteria level, and subsequently its overall score. While Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens,” explained the S&P 500 ESG in a blog post.

While the S&P 500 ESG removed Tesla, it also added five oil and gas companies, while retaining others such as Exxon Mobile. The contradiction resulted in Tesla CEO Elon Musk criticizing the index as a “scam”.

“Exxon is rated top ten best in world for environment, social & governance (ESG) by S&P 500, while Tesla didn’t make the list!”, said Musk on Wednesday in reaction to the news. “ESG is a scam. It has been weaponized by phony social justice warriors.”

Exxon is rated top ten best in world for environment, social & governance (ESG) by S&P 500, while Tesla didn’t make the list!

ESG is a scam. It has been weaponized by phony social justice warriors.

— Elon Musk (@elonmusk) May 18, 2022

Musk went on to say “.@SPGlobalRatings has lost their integrity” and “ESG is an outrageous scam! Shame on @SPGlobal.”

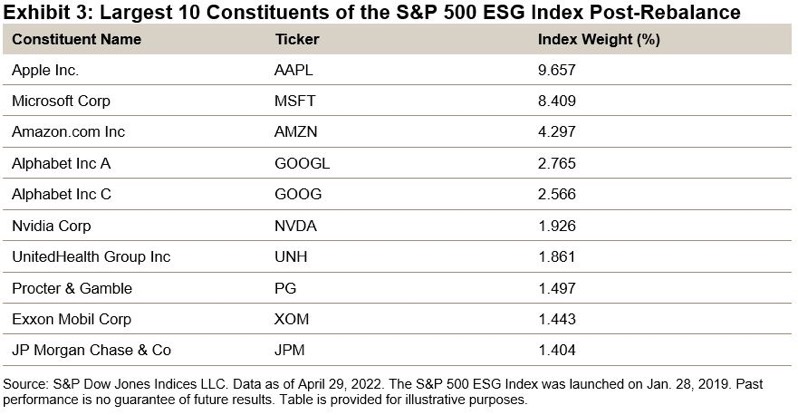

The top 10 largest companies in the S&P 500 ESG rebalance is led by Apple, followed by other tech giants such as Microsoft, Amazon, Alphabet, Nvidia and more. Exxon Mobile is ranked in 9th place.

Insane

— Elon Musk (@elonmusk) May 18, 2022

“So, while Tesla and others may not have been included in the index this year, the beauty of the annual rebalance is that they will once again have an opportunity to be reviewed for inclusion in years to come. For now, the (re)balancing act of the S&P 500 ESG Index has once again been achieved,” explained the S&P 500 ESG index.

It’s an odd move to remove Tesla while retaining and adding oil and gas companies. Martin Viecha, head of investor relations at Tesla, reacted to the news by saying, “A few of the factors contributing to its ESG Score were a decline in criteria level scores related to Tesla’s (lack of) low carbon strategy…And I thought pushing the whole industry toward electrification is a decent low carbon strategy,” followed by laughing emojis and sharing a screenshot of Tesla’s lead in producing electric vehicles, versus the rest of the industry.

…A few of the factors contributing to its ESG Score were a decline in criteria level scores related to Tesla’s (lack of) low carbon strategy…

And I thought pushing the whole industry toward electrification is a decent low carbon strategy 🤣🤣 pic.twitter.com/PkvZnGxJ5P

— Martin Viecha (@MartinViecha) May 18, 2022

Within Tesla’s recent 2021 Impact Report, the company said “current ESG evaluation methodologies are fundamentally flawed. To achieve acutely-needed change, ESG needs to evolve to measure real-world impact.” Despite Tesla’s goal to help the world transition to sustainable energy, the S&P 500 ESG index believes otherwise.