Elon Musk’s Twitter Takeover Happened at Never-Before-Seen Breakneck Speed, Say Insiders

Twitter announced the sale of its company to Elon Musk for $44 billion on Monday, in what was one of the largest and swiftest buyouts in Wall Street history.

Musk was deeply involved in the transaction of his Twitter takeover, despite him not looking at the social media company’s financials beyond what was publicly available, according to those familiar with the subject as detailed in a report from Bloomberg.

Compared to a buyout that involves several shareholders or a corporate bidder, Musk’s takeover saw him calling the shots as an individual investor, the sources say.

Bloomberg interviewed over half a dozen people directly affiliated with the transaction, and many of them similarly said that they had not seen a deal this large that had been completed so quickly, in their entire careers.

Elon Musk’s Business Plan for Twitter Helped Win Financial Backing from Wall Street: Report https://t.co/wH6afOcnwb

— TeslaNorth.com (@RealTeslaNorth) April 23, 2022

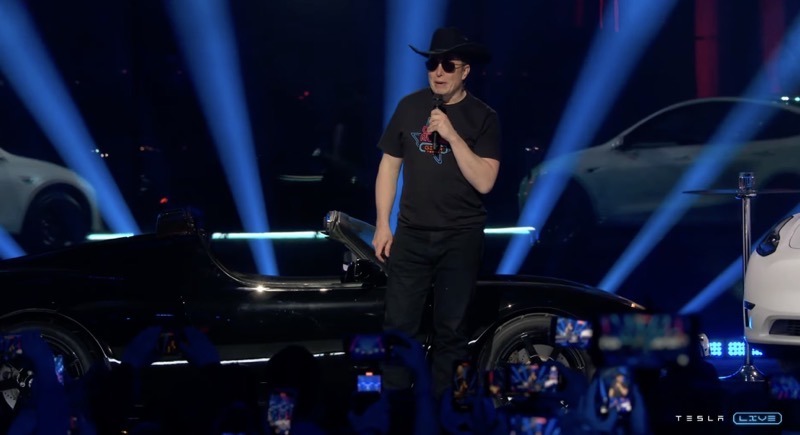

The report says Musk participated in video calls and presentations, along with sharing his vision of Twitter, in order to convince banks to get on board with working with him. Advisors worked two weekends in a row pulling all-nighters without sleep, for the deal codenamed ‘Project X’ at some banks. Musk called in for meetings from all over, including Texas, where the company’s headquarters are located.

Musk was seen as a “sponge” with banker lingo, leveraging the language himself in negotiations. Musk would also directly email bankers themselves to get their thoughts on parts of the deal, such as termination fees and thoughtfully weighed their opinions.

One unamed source said Musk was “curious, thoughtful and open to feedback” in private, despite having a public image of being spontaneous.

The news comes after Musk disclosed becoming Twitter’s largest shareholder with a 9.2-percent stake in the company earlier this month.

Musk was set to join Twitter’s Board of Directors, but ended up deciding not to following plans to hold a Twitter employee Ask-Me-Anything (AMA) session with Musk to address employee concerns.

It also comes after Musk asked a judge to halt the Securities and Exchange Commission’s (SEC’s) oversight of his Twitter account — a result of a 2018 tweet from Musk that the agency said had violated securities laws.