Tesla Vehicle Delivery Growth, Operating Margin Beats All Other Automakers

Tesla’s Q4 2021 earnings resulted in another record quarter, with revenue beating Wall Street’s expectations, at $17.71 billion.

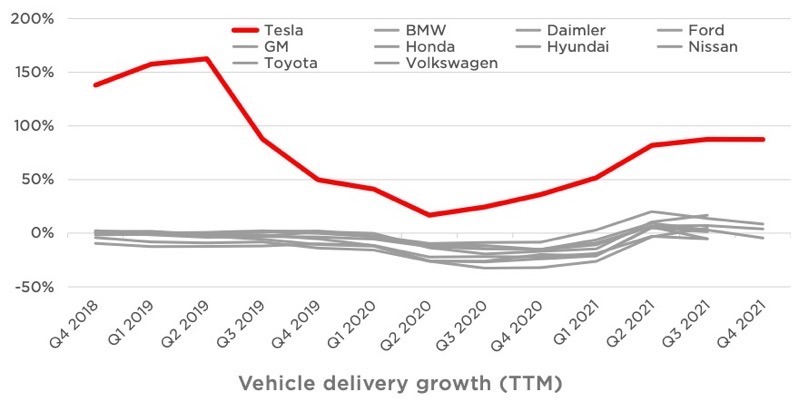

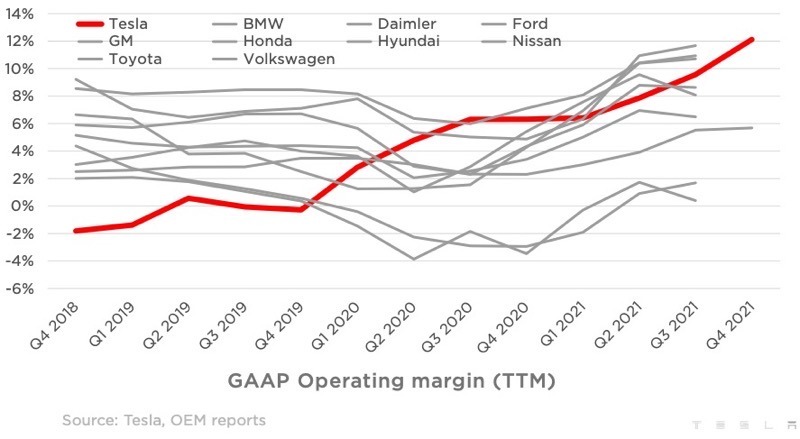

The automaker shared a couple of charts detailing its lead versus other established automakers, such as GM, Toyota, BMW, Honda and more.

Tesla’s vehicle delivery growth (time-to-market) currently continues to outpace legacy automakers, in particular for Q4. Tesla says “over a multi-year horizon, we expect to achieve 50% average annual growth in vehicle deliveries,” with the rate dependent on factors such as its equipment capacity, operation efficiency and the capacity and stability of its supply chain.

When it comes to GAAP operating margin, based on OEM reports out so far, Tesla is leading all automakers, at 14.7% in Q4. Tesla’s GAAP automotive gross margin in Q4 was 30.6%, up 648 basis points year-over-year.

“In Q3-2021 (the last widely reported quarter), Tesla achieved the highest operating margin across all volume OEMs,” said the automaker on Wednesday. “Cost (COGS) per vehicle dropped to ~$36,000 in both Q3 and Q4 2021. We believe our current projects, including large castings, structural battery pack, 4680 cells and many others, should help us continue to minimize our product cost,” said the company.

The latest data from Cox Automotive released on Tuesday says Tesla outsold BMW to take the crown in the 2021 luxury market.

“Tesla is still the dominant player, with 72% share of the EV market,” said Cox Automotive. “That is down from near 80% in 2020, but Tesla still delivered significant 71% year-over-year growth in a tough year.”

“Tesla didn’t only dominate the EV market, Tesla dominated the overall luxury market, outselling Audi, BMW, Lexus, and Mercedes-Benz in the U.S. market,” said Cox.