Elon Musk Says Renesas and Bosch’s Chip Supply is ‘Problematic’

Photo: via @skorusARK

As Tesla’s Chinese rivals NIO, Li Auto and Xpeng Motors continue to churn out electric vehicles in the world’s largest auto market, some analysts are speculating as to how the competitive sales and deliveries are trending.

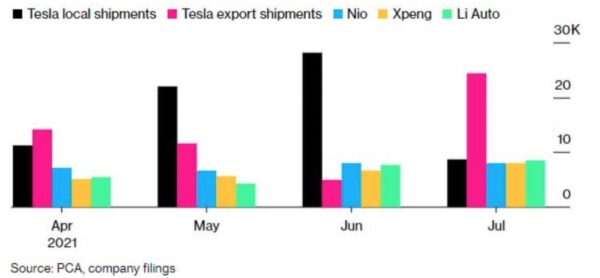

On Thursday, ARK Invest head @Cathie Wood shared a photo depicting Tesla’s shipments in China compared to NIO, Xpeng, and Li Auto.

The photo features data collected from the China Passenger Car Association (CPCA) and company filings, ultimately showing Tesla’s deliveries drop off at the onset of the new quarter to match those of the local car companies.

Noting the dip in local sales from Tesla in July, which almost matched those of NIO, Xpeng and Li Auto, Wood stated that Tesla “seems to understand that China would like local champions” in the electric vehicle (EV) space, but is “pleased” to be exporting such high-quality factory work from China.

Tesla makes cars for export in first half of quarter & for local market in second half.

As publicly disclosed, we are operating under extreme supply chain limitations regarding certain “standard” automotive chips.

Most problematic by far are Renesas & Bosch.

— Elon Musk (@elonmusk) August 12, 2021

Tesla CEO Elon Musk responded to the post, saying that the sales trends were due to the way Tesla manufactures vehicles for export and import over the course of a quarter – adding that current production is strained from “limitations regarding certain ‘standard’ automotive chips.”

Musk explained that the shape of the graph is largely due to the fact that Tesla produces export cars in the first half of the quarter, and instead produces for local markets in the second half of each quarter – which also explains why the end of each quarter sees such high volumes of increased deliveries.

Renesas Electronics Corp. based in Japan and Germany’s Robert Bosch GmbH have been similarly called out by other automakers over their chip supply shortages.

Earlier this year, a fire at a Renesas plant north of Tokyo was deemed to possibly affect production schedules at Ford Motor Co. In January, the chip shortage at Bosch resulted in Volkswagen AG and other suppliers discussing the possibility of claiming damages.

As for Bosch, it recently opened a $1.2 billion USD factory near Dresden in June, but the company remains susceptible to the ongoing shortage due to numerous factors.

A Bosch spokesperson told Bloomberg on Thursday, “In this tense situation, we are doing everything in our power to support our customers and are working flat out to keep up deliveries as much as possible,” further adding, “together with our customers and our suppliers, we have been working in task forces around the clock for weeks.”

During Tesla’s Q2 earnings call, Musk said the ongoing global semiconductor shortage “remains quite serious”, noting it’s unclear when the situation will get better. The shortfall in semiconductors has pushed back delivery dates for numerous Tesla vehicles, including the new Model S and Model X refresh to as far back as 2022 and the company’s Cybertruck as well.