Tesla to Join S&P 500 in December, Stock Surges 14% After Hours

It’s finally official–the S&P Dow Jones Indices has announced Tesla is set to join the S&P 500 on December 21, 2020.

“Tesla Inc. will be added to the S&P 500 effective prior to the open of trading on Monday, December 21 to coincide with the December quarterly rebalance,” explained a press release from the S&P Down Jones Indices.

“Due to the large size of the addition, S&P Dow Jones Indices is seeking feedback through a consultation to the investment community to determine if Tesla should be added all at once on the rebalance effective date or in two separate tranches ending on the rebalance effective date,” added the press release.

When a new company enters the S&P 500, one has to be removed. The company Tesla is replacing will be announced “closer to the rebalance effective date”, said S&P Dow Jones Indices.

It’s been a long time coming for Tesla to join the S&P 500, even after there was no news of it joining the index after five consecutive profitable quarters, going beyond the usual requirement of four straight.

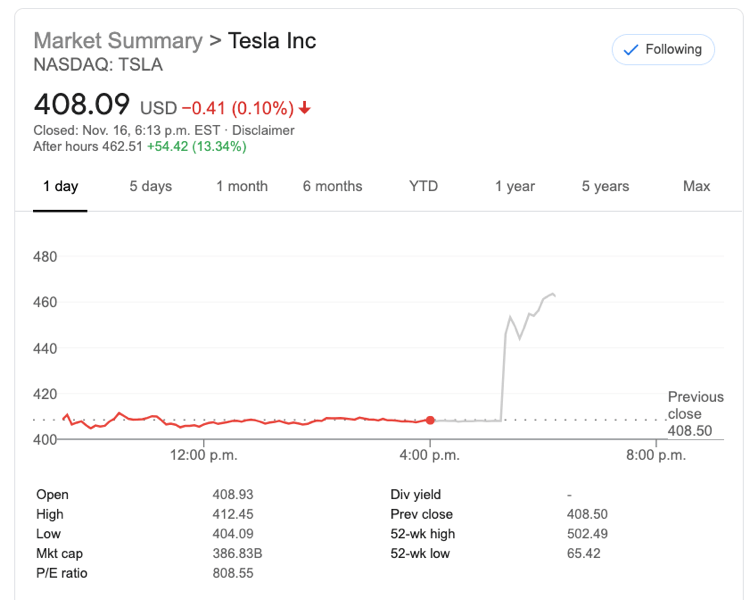

In after-hours trading, shares of Tesla are surging, up to 14% as of writing, to $465 per share. Tesla closed with a market cap of $386 billion on Monday, and when it enters the S&P 500, it will be one of the top ten largest companies.