Tesla Stock Gets Price Target Beyond $2,000 by Morgan Stanley

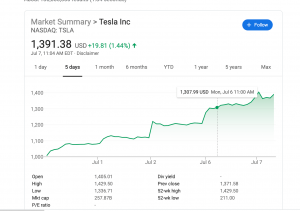

There have been many doubters of both Tesla and Elon Musk, and some believe that the carmaker simply won’t be able to survive in the coming years. Those skeptics must be baffled right now, as the company recently beat expectations regarding car deliveries and their share price continues to climb. As of press time, Tesla’s stock is reaching $1400, and actually briefly rose above $1400 for some time.

Morgan Stanley analysts are now lifting their bull-case price target to $2,070 given the fact that Tesla shares have shown such strength when it comes to rallying back. Analyst Adam Jonas pointed out the one way in which Tesla has proved different from much of its competition, stating: “Demand is holding up better” for Tesla, and he acknowledged that the investment now appears less risky than before. He praised Tesla’s “year on year resilience”, as well.

Jonas isn’t alone. Dan Ives also believes that Tesla stock could reach $2,000, and believes that it can happen over the next 12 months. For those who are unaware, Ives is an analyst for Wedbush Securities. It should also be noted that Ives had an official price target of $1250, and that the $2000 target was a “bull case.” At $2000 a share, Tesla would be valued at around $370 billion.

Interestingly enough, Jonas maintained his “underweight” rating. What is his reasoning? He believes that there are risks regarding profit sustainability in China, and that the market isn’t accounting for the inevitable competition from other world-renowned tech companies such as Alphabet and Amazon. As for his “regular price target”, Jonas revised this target from $640 to $750, suggesting that there is still significant downside for Tesla as an investment.

Even if Tesla stock does reach $2,000, some question whether there would be a stock split to attract new traders and/or investors. Either way, one thing is clear: Tesla is clearly proving many Wall Street doubters wrong. In fact, the company recently mocked short sellers by selling actual “short shorts”, and there was so much interest that the products ended up momentarily crashing the website.

As of writing, Tesla is trading at $1,397 per share, up 1.87% for the day, down slightly after reaching yet another all-time high, of $1,429.50.