Tesla Says Full $7,500 Tax Credit to End for Model 3

Tesla has issued an advisory to its customers regarding the potential reduction of the $7,500 federal tax credit for certain vehicle models starting in 2024. The company urges customers to take delivery of eligible vehicles by December 31, 2023, to fully benefit from the current tax credit offer.

Under the current federal guidelines, customers who purchase a new qualified Tesla and meet all federal requirements are eligible for a tax credit of up to $7,500. However, this tax credit is set to end for the Model 3 Rear-Wheel Drive and Model 3 Long Range after December 31, 2023, following the new guidance under the Inflation Reduction Act (IRA).

The tax credit is available only for eligible cash or loan purchases. Tesla has also outlined adjusted gross income limitations for the tax credit: $300,000 for married couples filing jointly, $225,000 for heads of households, and $150,000 for all other filers.

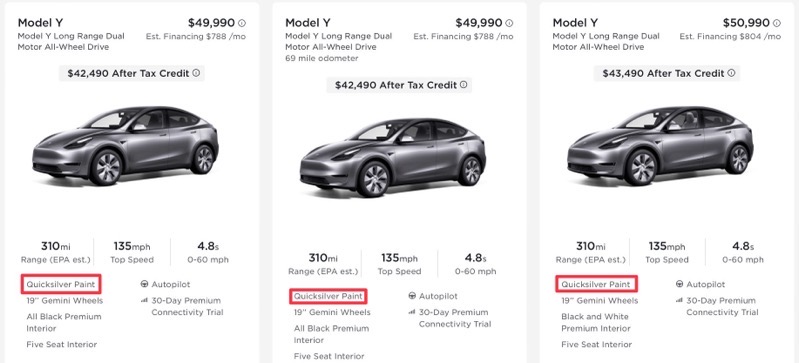

Additionally, there are price caps on the vehicle’s Manufacturer’s Suggested Retail Price (MSRP) at the time of delivery to qualify for the tax credit. These caps include optional equipment physically attached to the vehicle at delivery but exclude software features, accessories, taxes, and fees. The price caps are set at $55,000 for Model 3, and $80,000 each for Model X and Model Y.

Tesla advises customers to assess their eligibility for any tax credits based on their personal tax situation and recommends consulting with a tax professional for guidance.

So what should you do? It’s best to check Tesla’s existing inventory and take delivery before December 31, 2023, so you can qualify for the full $7,500 tax credit.