Mazda CEO Claims EV Demand Shift is ‘Uncertain’

Masahiro Moro, the newly appointed global CEO of Mazda, is steering the company towards a future heavily invested in electric vehicles (EVs).

Moro, who previously led Mazda’s North American operations to record U.S. sales, is now focused on launching Mazda’s first dedicated electric vehicle platform. By 2030, Mazda anticipates up to 40% of its global sales to come from EVs.

In an interview with Automotive News’ Hans Greimel at Mazda’s Tokyo office, Moro shared insights into the company’s direction and collaboration with Toyota on electrical and software architectures. “To make the battery EV smarter and connected to society, the software architecture is going to be crucial,” Moro said. He revealed that nearly 90% of Mazda’s software architecture would be in common with Toyota, emphasizing the importance of this partnership in resource-intensive areas.

Moro also discussed Mazda’s sales goals, projecting that U.S. sales could challenge 400,000 units next year and North American sales could approach 600,000 units by 2025. He noted that the global sales target for 2025 is now 1.6 million units, adjusted from 1.8 million due to various factors, including the dissolution of an alliance with a Chinese partner and the transition to electrification.

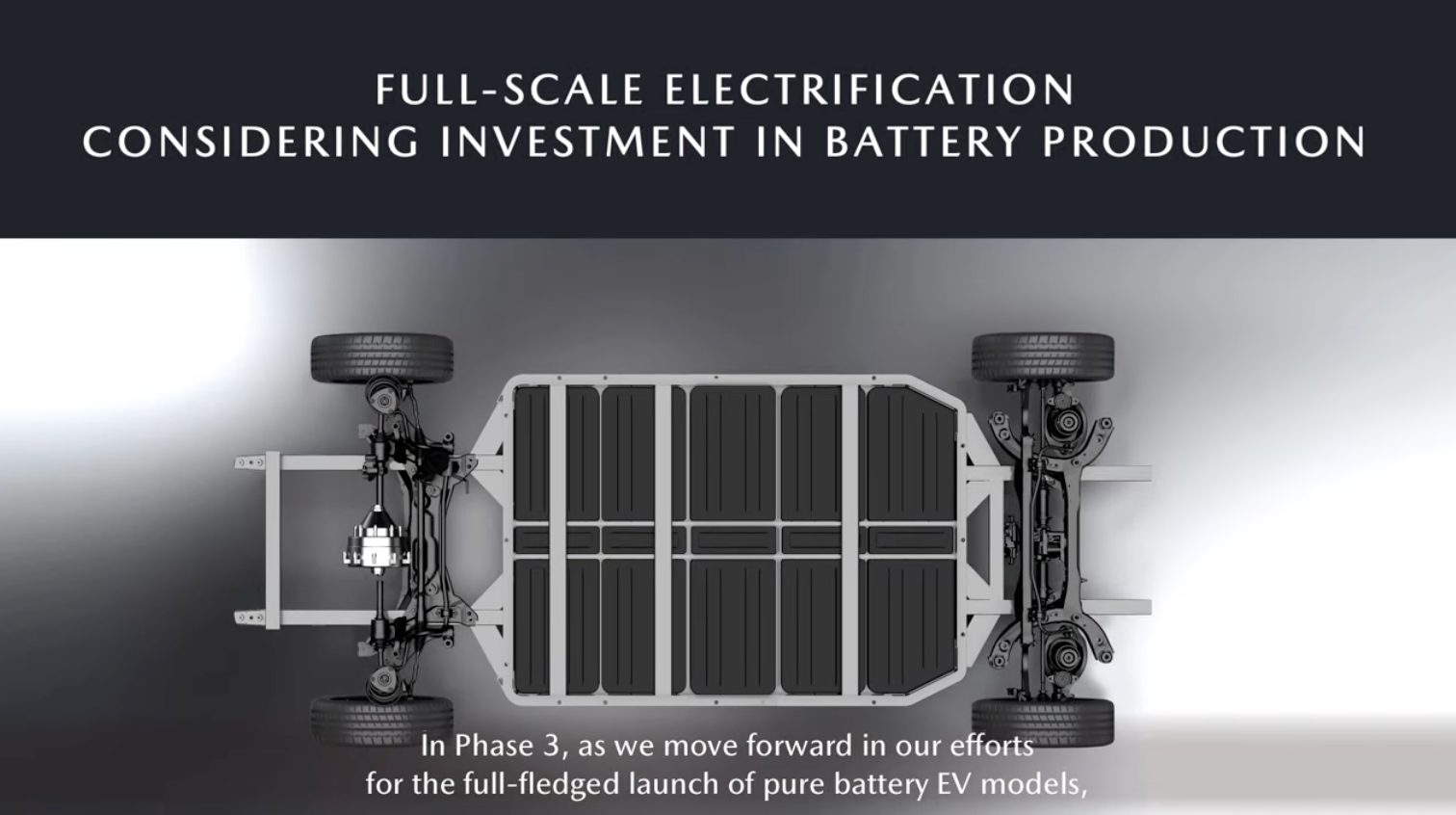

Regarding Mazda’s EV platform, Moro mentioned that it is still under consideration, with a focus on efficiency and lightweight design. The powertrain concept involves scalable platforms with three motor sizes to cater to different customer needs. “We are evaluating customer needs, because if you use a high-power motor, it requires a lot of battery capacity, which makes the vehicle heavier and more expensive,” Moro explained.

The new e-Mazda division, established in November, is a testament to Mazda’s commitment to electrification. This division, consisting of nearly 100 dedicated personnel, is responsible for designing the platform, vehicle, and business side of Mazda’s EV strategy.

Moro also highlighted the potential for production expansion, including developing and producing EVs from Japan and considering North American production in the future. He envisions a diverse EV portfolio by 2030, with seven or eight BEVs globally, focusing on SUVs with efficient designs.

The collaboration with Toyota on software architecture is expected to save Mazda a significant amount of investment, allowing the company to develop two complete products with the saved resources. Moro emphasized the shift from competitive to collaborative areas in the industry, stating, “We are in a phase where that definition is changing big-time.”

As for the percentage of EV sales by 2030, Moro admitted the uncertainty, saying, “Everyone is scaling back investment or pushing back timelines. The current trajectory may result in the lower percentage of that range. But nobody really knows.”

While Mazda takes its time to shift to EVs, Tesla remains a leader at the moment with its Model Y on track to become the best-selling car worldwide. Japanese automakers such as Toyota, Mazda and Honda aren’t shifting to EVs fast enough, and instead seem intent on detailing why the transition is taking longer than expected, rather than coming up with solutions.

Currently, Mazda has its MX-30 EV that has 161 km of range (100 miles) that costs $42,650 CAD. A Tesla Model 3 RWD in existing inventory on sale, after federal and provincial incentives in Quebec and with 438km range (272 miles) costs $42,490 CAD, and comes with tech, safety and software that’s far superior than what’s inside the two-door MX-30.