Tesla’s Shanghai Plant Sees August Production Surge

Tesla’s manufacturing output at its Shanghai plant witnessed a significant rebound in August, marking a pivotal moment as the company strives to match Wall Street’s production expectations.

In August, Tesla reportedly dispatched 84,159 vehicles from the Shanghai factory, a noteworthy increase from 64,285 in July and 76,695 the previous year, as per the Chinese Passenger Car Association, reports Barron’s.

The July slump in production numbers was attributed to plant retooling—a customary summer break that automakers utilize for facility upgrades and staff vacations. Tesla CEO Elon Musk referred to these upgrades during the company’s July earnings call.

The recent figures for August encompass wholesale shipments, which include exports. Data on domestic sales usually follows a few days post the release of wholesale statistics.

This boost in the wholesale number highlights Tesla’s robust production coupled with a surge in demand. It’s noteworthy that most Tesla cars are bought directly from the brand as Tesla operates without intermediary dealers, distinguishing it from traditional automakers.

Cumulatively, in 2023, Tesla has manufactured approximately 625,000 vehicles in China—a leap from the 400,000 in the corresponding period of 2022. While plant capacity has grown, 2022 also saw the shadow of COVID-19 lockdowns affecting the Chinese automobile industry’s output.

Tesla initiated its vehicle production in Shanghai towards the end of 2019. With August marking the fourth-highest monthly output, the company set its record in November 2022, producing a staggering 100,291 units.

Despite these impressive numbers, Tesla shares saw minimal reaction. The stock dipped slightly by 0.2% in premarket trading. Analysts predict around 470,000 unit deliveries for the third quarter, a slight increment from the second quarter’s 467,000. Shares of Tesla closed up 4.69% on Tuesday at $256.49.

Tesla’s share price took a 5.1% hit last Friday, amidst the buzz surrounding the pricing of its newly upgraded Model 3 Sedan for China and Europe. Although a price hike was anticipated to buoy the share price, the absence of substantial new features left some investors underwhelmed.

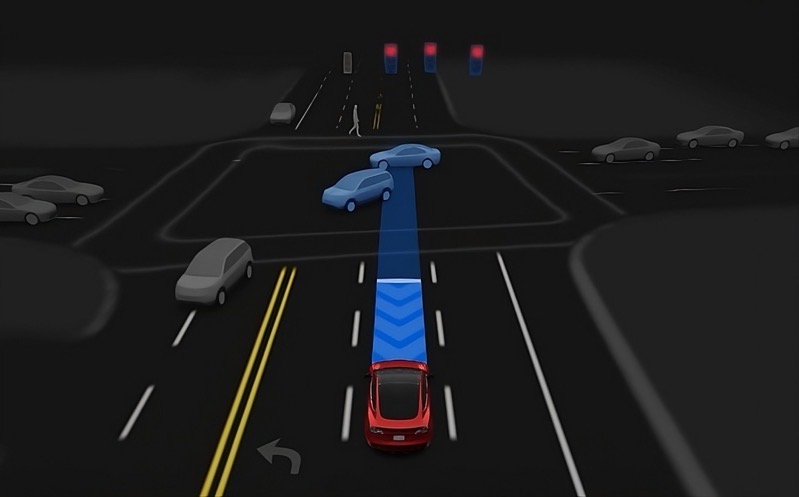

Furthermore, Tesla reduced its Full Self-Driving software price from $15,000 to $12,000 USD, and simultaneously slashed prices for its Models S and X. Nonetheless, Tesla’s stock has risen by almost 99% this year, indicating strong investor confidence.