Tesla Eyes Samsung for Hardware 5 Self-Driving Chips: Report

In a significant market shift, the automotive semiconductor sector is rapidly transitioning from being centered around low-end products to becoming a significant demand driver for high-performance chips. This trend comes as autonomous driving and infotainment functionalities in vehicles are becoming increasingly sophisticated. Industry insiders confirmed on August 28 that this development is heating up the competition between Samsung Electronics and Taiwan Semiconductor Manufacturing Company (TSMC).

Previously, the price of automotive semiconductor chips was a mere tenth of that of mobile application processors (APs), making them low-margin products. However, this landscape is changing dramatically. The rise of electric and autonomous vehicles is fueling an explosive demand for high-performance automotive semiconductors.

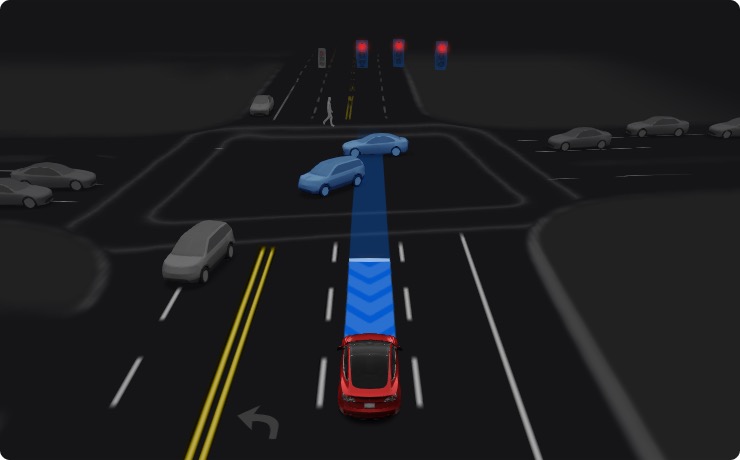

Samsung Electronics, a dominant player in legacy processes, could potentially gain more foundry customers due to the miniaturization trend in the automotive semiconductor market. The Korean tech giant is currently favored to secure Tesla’s order for its fifth-generation autonomous driving chip (HW 5.0) that employs a state-of-the-art 4-nanometer process, reports Business Korea. Samsung, already a supplier of 14-nm fully self-driving (FSD) semiconductors to Tesla, has ambitious plans to venture into a 2-nm process for automotive chips by 2027.

Last month, Samsung also revealed its intention to dominate the automotive memory market by announcing the mass production of its next-generation 256 GB Universal Flash Storage (UFS) 3.1 NAND Flash memory for in-vehicle infotainment systems. The company aims to surpass the current industry leader, Micron, by 2025.

Meanwhile, TSMC is not to be left behind and is actively investing in the automotive semiconductor market. The company has confirmed plans to build a €10 billion (US$14.45 billion) semiconductor facility in Dresden, Germany, that will focus primarily on automotive microcontrollers based on legacy 28-nm processes. Additionally, a factory under construction in Kumamoto Prefecture, Japan, will also specialize in automotive semiconductors and image sensors.

Both Samsung and TSMC are making strategic moves to secure their positions in this rapidly evolving market, signaling a new era for automotive semiconductors.

Back in July, a similar report echoed Samsung was slated to make Tesla’s Hardware 5 chips, also based on a 4-nanometer process.