Tesla Increases 2023 Capital Expenditure Forecast Amid Rising EV Demand

Summary:

- Tesla raises its 2023 capital expenditure forecast to between $7 billion and $9 billion, up from $6 billion to $8 billion, in response to growing EV demand.

- The company is aggressively ramping up production, expanding its Nevada Gigafactory, and increasing output at its Berlin and Austin factories.

- For the first time, Tesla has begun producing a version of the Model Y in Shanghai for the Canadian market, marking its first shipment of vehicles to North America from China.

Tesla Inc has announced an increased capital expenditure forecast for 2023 in response to growing demand for electric vehicles and the company’s aggressive production ramp-up.

The automaker now expects to spend between $7 billion and $9 billion this year, up from its previous estimate of $6 billion to $8 billion, while maintaining its spending outlook for the following two years, according to its Form 10-Q filed on Monday morning, reports Reuters.

“Our capital expenditures are typically difficult to project beyond the short-term given the number and breadth of our core projects at any given time, and may further be impacted by uncertainties in future global market conditions,” said Tesla.

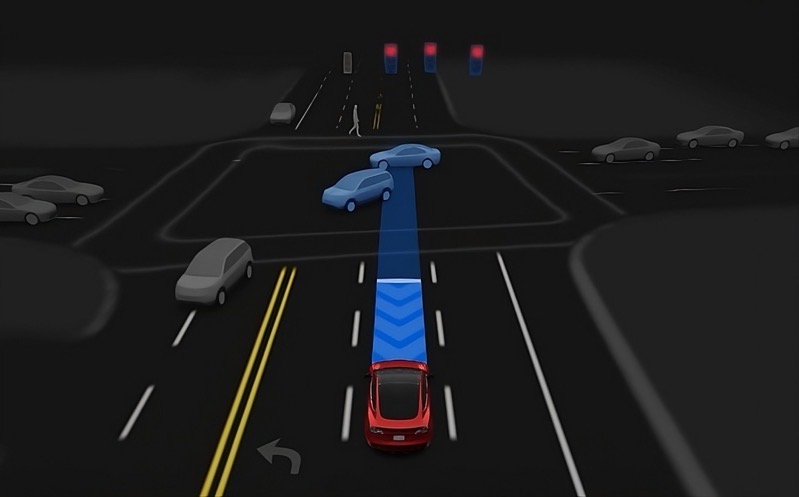

“We are simultaneously ramping new products, ramping manufacturing facilities on three continents, piloting the development and manufacture of new battery cell technologies and investing in autonomy and other artificial intelligence enabled products, and the pace of our capital spend may vary depending on overall priority among projects, the pace at which we meet milestones, production adjustments to and among our various products, increased capital efficiencies and the addition of new projects,” detailed the automaker.

“Owing and subject to the foregoing as well as the pipeline of announced projects under development, all other continuing infrastructure growth and varying levels of inflation, we currently expect our capital expenditures to be between $7.00 to $9.00 billion in 2023 and in each of the following two fiscal years,” revealed Tesla.

“We ended the first quarter of 2023 with $22.40 billion in cash and cash equivalents and investments, representing an increase of $217 million from the end of 2022. Our cash flows provided by operating activities during the three months ended March 2023 and 2022 were $2.51 billion and $4.00 billion, respectively, representing a decrease of $1.48 billion,” said Tesla.

“Capital expenditures amounted to $2.07 billion during the three months ended March 31, 2023, compared to $1.77 billion during the same period ended March 31, 2022. Sustained growth has allowed our business to generally fund itself, and we will continue investing in a number of capital-intensive projects in upcoming periods,” explained the automaker.

Despite a 3.3% drop in Tesla’s share price in morning trading, the company remains committed to prioritizing sales growth in a weak economy and pursuing Musk’s ambitious goal of selling 20 million electric vehicles by 2030. Achieving this target would make Tesla the largest automaker in history, accounting for nearly 20% of the global vehicle market.

“Our business has recently been consistently generating cash flow from operations in excess of our level of capital spend, and with better working capital management resulting in shorter days sales outstanding than days payable outstanding, our sales growth is also facilitating positive cash generation,” said Tesla.

“We have and will continue to utilize such cash flows, among other things, to do more vertical integration, expand our product roadmap and provide financing options to our customers. On the other hand, we are likely to see heightened levels of capital expenditures during certain periods depending on the specific pace of our capital-intensive projects and rising material prices and increasing supply chain and labor expenses resulting from changes in global trade conditions and labor availability associated with the COVID-19 pandemic,” it contined.

“Overall, we expect our ability to be self-funding to continue as long as macroeconomic factors support current trends in our sales,” noted Tesla.

In January, Tesla allocated $3.6 billion for the expansion of its Nevada Gigafactory complex, where the company will mass-produce its Semi truck and establish a plant for the 4680 cell. This facility will have the capacity to produce enough batteries for 2 million light-duty vehicles annually.

Additionally, Tesla is increasing production at its Berlin and Austin factories and plans to open a Gigafactory in Mexico as it seeks to expand its global output. Reuters reported that the company has started producing a version of the Model Y in Shanghai for the Canadian market, marking the first time Tesla will ship vehicles to North America from China.