Tesla Gets Bull Price Target of $1,800 on Expected 2022 Growth: Wedbush

Photo: MarketWatch

Many experts are eager to see what 2022 will hold for Tesla’s stock, including one high-profile analyst who says the Chinese auto market remains the “linchpin” for the U.S. automaker’s continued success.

Tesla’s shares will see big gains again in 2022, according to Wedbush analyst Daniel Ives, during which he predicts Tesla will sell around 2 million electric vehicle (EV) units within the year, as reported by Business Insider on Tuesday.

In order to do so, Ives also emphasized the importance of the Chinese auto market, which he says could make up nearly half of the 2 million deliveries estimated.

Tesla Sold 52,859 Cars in China in November 2021 https://t.co/AZKJbn9lhw

— TeslaNorth.com (@RealTeslaNorth) December 8, 2021

In a memo written on Tuesday, Ives said, “The linchpin to the overall bull thesis on Tesla remains China, which we estimate will represent 40 percent of deliveries for the EV maker in 2022.” Ives continued, “We believe by the end of 2022 Tesla will have the capacity for overall ~2 million units annually from roughly 1 million today.”

Ives said earlier this year that Tesla’s stock would hit four digits heading into 2022 in October, and in the weeks following the stock topped upwards of $1,000 – where it has been floating ever since.

The Wedbush analyst also said there’s a bull price target of $1,800 per share. He believes Tesla could rise to $1,400 within the next 12 months, based on its growth trajectory. Tesla’s problem right now is overwhelming demand, and not supply, says Ives.

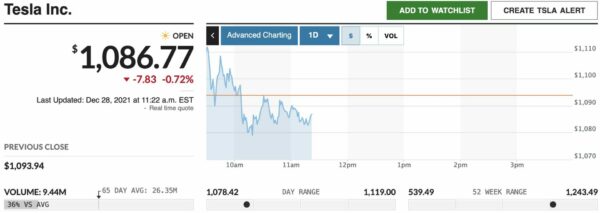

As of writing on Tuesday, Tesla’s (TSLA) shares are trading at $1,086.77 (-$7.83), down 0.72 percent from market open.