Tesla Price Target Raised to $1,080 by Oppenheimer

In a Q1 earnings call on Monday, Tesla (TSLA) reported a record net income of $438 million, with $10.39 billion in revenue. Following the call, one analyst has upgraded his price target for the company’s shares.

Oppenheimer analyst Colin Rusch raised Tesla’s price target to $1,080 from $1,036 on Tuesday, maintaining an Outperform rating on the stock (via Sawyer Merritt). The analyst cited Tesla’s Full Self-Driving (FSD) plans and its ability to deliver “strong operational results,” despite setbacks encountered by the auto industry in the past year.

BREAKING: Oppenheimer analyst Colin Rusch raised the price target on $TSLA to $1,080 (from $1,036). Outperform rating.

“With prod capacity at 1.05M vehicles & 2 new factories scheduled to begin ramping later this year & in early 2022, we see significant headroom for deliveries” pic.twitter.com/iNMvjqeea3

— Sawyer Merritt (@SawyerMerritt) April 27, 2021

In a note, Rusch said, “TSLA delivered strong operational results while suggesting a brisk rollout of FSD in urban environments and that a subscription-based model would be revealed soon.”

Later in the note, Rusch continued, “With production capacity at 1.05 million vehicles now and two new factories scheduled to begin ramping later this year and in early 2022, we see significant headroom for deliveries, which likely will support shares as the story becomes more focused on validation and monetization of FSD.”

Per the call, Tesla is now expected to produce over 1 million cars per year, and this fact along with FSD’s official rollout, expected to come soon, may also someday lead to the company piloting driverless robo-taxis, which CEO Elon Musk believes will justify the company’s impressive valuation.

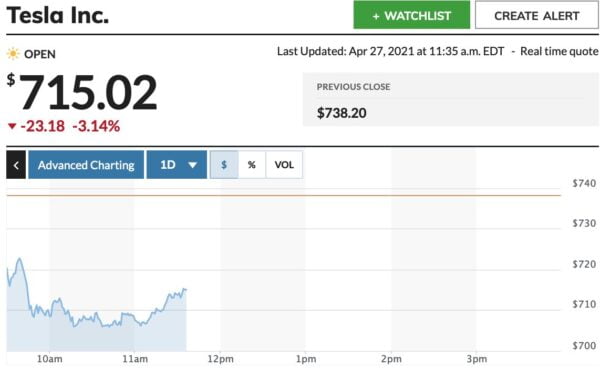

At the time of writing, Tesla’s shares (TSLA) were trading for $715.02, down 3.14% from Tuesday’s open.