Tesla’s First Day in the S&P 500 Gets Rocky Start

Tesla’s entry into the S&P 500 index was expected to be a rocky one, although neither bulls or bears could be sure what that truly meant – until Monday when the electric vehicle (EV) company’s entry became offical.

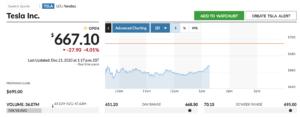

After its entry into the S&P on Monday, Tesla’s (TSLA) shares fell as much as 6%, as investors who bought the stock prior to the entry cashed out, according to CNBC. Even upon entry, Tesla has the fifth-largest weighting in the index at 1.69%, and it’s the sixth-largest company in the benchmark, which also includes companies like Apple, Microsoft, Amazon, and Facebook, among others.

Congratulations to @elonmusk @tesla for the hard work and crazy amount of hours to get into the S&P 500. The road wasn’t easy and the hate was real but cheers to you. pic.twitter.com/1uwCsINwLw

— Tesla Owners Silicon Valley (@teslaownersSV) December 21, 2020

Tesla currently trades at 186 times forward earnings, making the company one of the most expensive companies to ever join the index. CEO Elon Musk earlier said that the company’s stock could be “crushed like a souffle under a sledgehammer,” alluding to the potential risks of the company’s current valuation as well as the S&P entry in weeks to come.

As rocky as the company’s debut in the index has been, it’s also no surprise to analysts, given how volatile Tesla’s stock is compared to that of the average S&P company. Still, if it can manage some stability and resistance to short-sellers as the world transitions to EVs, Tesla will likely stay the course for the long haul, with gradual, continual growth.

At the time of writing, Tesla’s (TSLA) shares are worth $667.10 (USD), down 4.01% from Monday’s opening price.