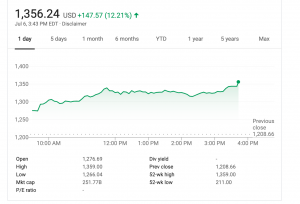

Tesla Shares Surge 13% to Record High Based on Strong Q2

During a time where the pandemic is affecting the performance of many different car companies, Tesla continues to defy the odds. The carmaker is up big today, surging up over 13% as of press time. Many credit Tesla’s surge to the fact that JMP Securities has revised its price target from $1050 to $1500. This would mean that Tesla stock could potentially increase by 24% this year, despite the fact that it is already up over 210% since the beginning of the year.

JMP Securities analyst Joseph Osha believes that Tesla has strong momentum with its recent delivery numbers, especially given the fact that many other automobile companies have been significantly affected by coronavirus. He also stated that he believes that Tesla is poised to become a $100 billion company “with 20% EBITDA margins by 2025.” The firm points out that if Tesla is already putting up numbers like 90,000 during a quarter affected by a pandemic, that “130K to 140K cars per quarter” by the end of the year may be possible.

Elon Musk seems to be quite happy about the stock’s performance, and has continued to taunt Tesla short sellers like the billionaire CEO has for years. In fact, Tesla recently sold limited edition “short shorts” in order to celebrate the company’s rise in share prices. The shorts were quite popular and sold out relatively quickly. Musk even shared that the interest in the shorts “broke the website.”