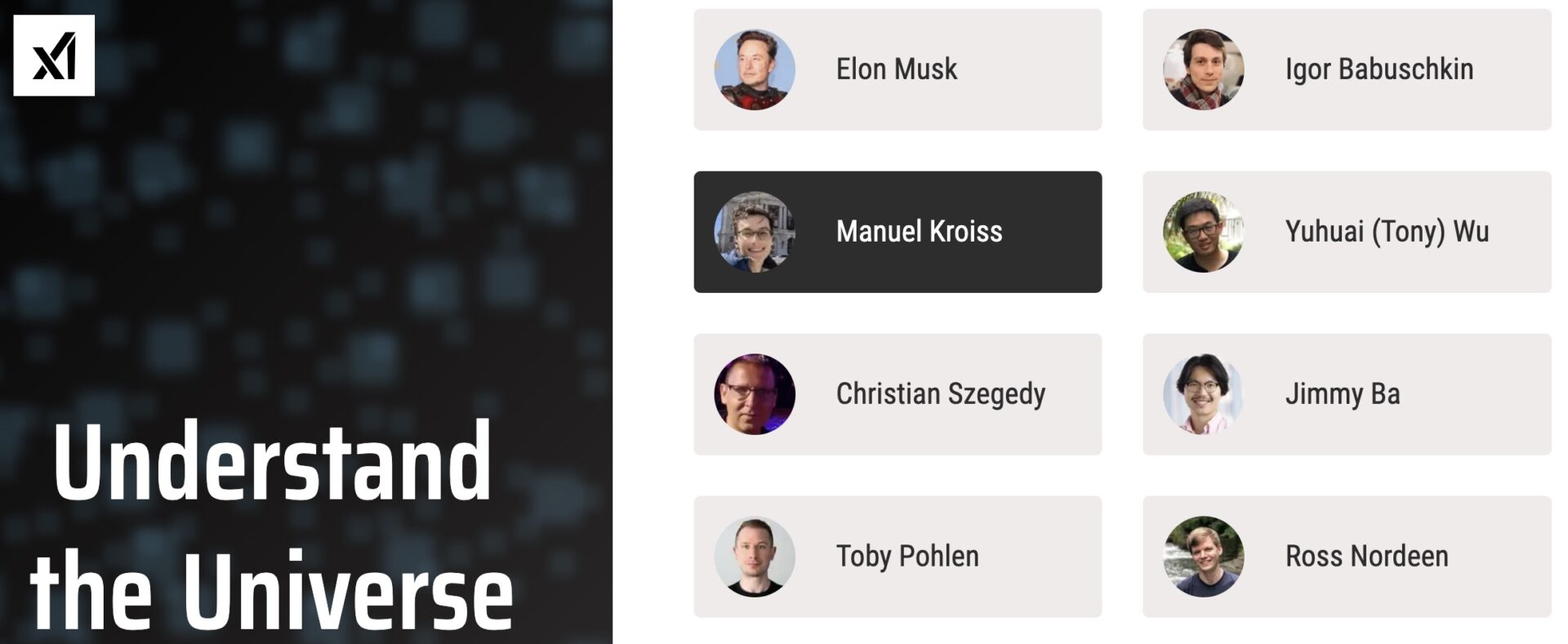

Tesla Seeks Retail Investor Support for Musk’s $56B Pay Package

Tesla is seeking the support of its substantial base of retail investors to approve CEO Elon Musk’s $56 billion pay package.

According to a person familiar with the matter, Bloomberg reports the company’s board has hired a strategic adviser and is working with an outside law firm to drive this initiative.

A dedicated “Vote Tesla” website has been established to encourage retail investors, who hold an estimated 42% of Tesla’s shares, to participate. The website promotes online voting and features a video with Board Chair Robyn Denholm, emphasizing the importance of supporting Musk’s compensation for Tesla’s growth. “We don’t believe one judge’s opinion should void the will of millions of votes cast by all of the owners,” Denholm states in the video.

The initiative comes ahead of Tesla’s annual meeting on June 13, where investors will vote on the 2018 compensation agreement that was vetoed by a Delaware judge three months ago. The judge ruled that Tesla directors had not acted in the best interests of investors.

While the vote is advisory, it could significantly impact Musk’s leadership. A majority approval would support the board’s argument against the court’s decision, while a loss would be a major setback. Musk has indicated that failing to secure a 25% equity stake in Tesla could lead him to develop products outside the company. The reinstated pay package would allow him to nearly double his current holding to approximately 21%.

On Musk’s social media platform X, Tesla fans have been expressing their support for the CEO with posts tagged #VotedTesla24. Musk has encouraged shareholders to participate, echoing messages from prominent supporters like Alexandra Merz, known as “Tesla Boomer Mama,” who spoke with Bloomberg.

“I want to make sure that retail investors vote,” Merz said. “But I also want people to reach out to their fund managers.”

Despite this support, the board faces challenges in securing enough votes. Historically, retail investors have low participation rates in annual meetings. Additionally, significant retail investor Leo KoGuan has publicly opposed the pay deal and criticized Musk’s management. “He has to respect and obey the court’s decision,” KoGuan, who owns about 0.8% of Tesla, stated in an email.

Tesla’s financial performance has been under pressure amid a global slowdown in electric vehicle sales. Recently, the company announced a 10% reduction in global headcount and has seen several top executives leave. The stock has declined 29% this year compared to a 10% gain in the S&P 500.

Observers are awaiting recommendations from proxy advisory firms Institutional Shareholder Services Inc. and Glass Lewis & Co., which could influence votes, especially from passive fund shares. Tesla’s largest investors, Vanguard and BlackRock, have declined to comment on their voting plans.

The Tesla board won the 2018 pay vote with 73% support, but the current situation presents new challenges. Tesla’s market capitalization has fallen below $600 billion, and Musk’s controversial posts on X have drawn new critics. Despite this, Musk remains a key figure in Tesla’s transformation, and many shareholders continue to praise his contributions, urging others to vote in favor of the pay deal.