Tesla Q4 Results: Model Y Best-Selling Car Globally in 2023

Tesla announced remarkable financial results for the fourth quarter and the entire year of 2023 on Wednesday.

The company’s GAAP operating income reached $8.9 billion for the year, with $2.1 billion recorded in the fourth quarter alone. The GAAP net income stood at an impressive $15.0 billion for 2023, skyrocketing to $7.9 billion in Q4. Additionally, non-GAAP net income was $10.9 billion for the year, with $2.5 billion in Q4.

A significant boost in Q4 earnings was attributed to a one-time non-cash tax benefit of $5.9 billion, related to the release of a valuation allowance on certain deferred tax assets.

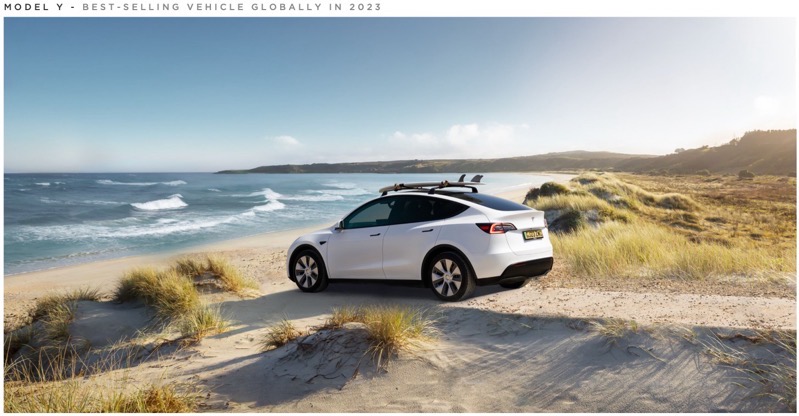

In a groundbreaking achievement for electric vehicles (EVs), Tesla’s Model Y emerged as the best-selling vehicle globally in 2023, with over 1.2 million units delivered. This milestone highlights a significant shift in the automotive industry, proving the increasing viability and popularity of EVs.

Tesla’s financial health remained robust, with $4.4 billion in free cash flow in 2023, a year marked by the company’s highest capital expenditures and research & development expenses. The Energy Storage deployments reached 14.7 GWh, more than doubling from the previous year. Profits from the Energy Generation and Storage business nearly quadrupled in 2023, with the Services & Other business segment transforming from a $500 million loss in 2019 to a $500 million profit in 2023.

In addition to these financial successes, Tesla reported a sequential decline in the cost of goods sold per vehicle in Q4. The company remains focused on increasing output, investing in future growth, and achieving further cost efficiencies in 2024.

Late December 2023 saw the rollout of V12 of Tesla’s Full Self-Driving (FSD) Beta. This advanced system, trained on data from over a million vehicles, uses artificial intelligence to control vehicle operations, marking a significant step toward full autonomy.

Looking ahead, Tesla is gearing up to bring its next-generation platform to market, with production planned to start at Gigafactory Texas. This new platform is expected to revolutionize vehicle manufacturing.

In operational highlights, Tesla’s Model Y became the world’s best-selling vehicle, and the company achieved a 125% growth in energy storage deployment, reaching 14.7 GWh in 2023. The company’s cash and investments increased by $3.0 billion in Q4, totaling $29.1 billion, ensuring a strong financial position for future endeavors.

Tesla’s 2023 annual report showcases a significant expansion in its vehicle production capacity across various regions and models. The company has made notable strides in increasing its manufacturing capabilities globally.

Current Installed Annual Vehicle Capacity:

- California:

- Model S / Model X: 100,000 (Production)

- Model 3 / Model Y: 550,000 (Production)

- Shanghai:

- Model 3 / Model Y: Over 950,000 (Production)

- Berlin:

- Model Y: 375,000 (Production)

- Texas:

- Model Y: Over 250,000 (Production)

- Cybertruck: Over 125,000 (Production)

- Nevada:

- Tesla Semi: Pilot production

- Various:

- Next Gen Platform: In development

- TBD:

- Roadster: In development

It is important to note that installed capacity does not equate to the current production rate, as production rates depend on multiple factors including equipment uptime, component supply, downtime for factory upgrades, regulatory considerations, and others.

Market Share and Production Highlights:

- After a scheduled global factory shutdown in Q3, Tesla achieved a record annualized run rate of nearly 2.0 million vehicles in Q4.

- The refreshed Model 3, featuring a quieter cabin, ventilated seats, rear seats screen, longer range, and other improvements, is now globally available.

- US (California, Nevada, and Texas): Tesla’s Fremont factory, previously owned by another automaker, had a record output of 430,000 vehicles in a year. In 2023, Tesla Fremont produced nearly 560,000 vehicles. At Gigafactory Texas, Tesla began Cybertruck production and delivered the first units to customers, expecting a longer ramp due to manufacturing complexity.

- China (Shanghai): The Shanghai factory resumed normal production rates in Q4 after scheduled downtime in Q3. The updated Model 3 production ramped up to full speed in less than two months.

- Europe (Berlin-Brandenburg): The Berlin factory saw Model Y production continue to grow in Q4, reaching a record weekly production rate and a sequential increase in total production volume for the seventh consecutive quarter.

Key Highlights:

Artificial Intelligence Software and Hardware:

- Tesla released its latest Full Self-Driving (FSD) Beta software (V12) to select employees and customers, enhancing the driving experience with end-to-end training.

- The 2nd generation of the Optimus robot was introduced, featuring Tesla-designed actuators, sensors, and improved AI capabilities.

- Both FSD Beta and Optimus utilize similar technology pillars, including real-world data, neural net training, and advanced hardware and software.

Vehicle and Other Software:

- The Cybertruck was delivered with a new user interface and Etherloop communication bus, reducing wiring and increasing data efficiency.

- Tesla vehicles now display a high-fidelity 3D rendering of surroundings for parking, even without ultrasonic sensors.

- Wireless Bluetooth headphones can be paired with the rear screen for entertainment purposes.

- FleetAPI enables enhanced integration and management of Tesla devices through third-party solutions.

Battery, Powertrain & Manufacturing:

- Cost of goods sold per vehicle declined sequentially to slightly above $36,000.

- Despite approaching the cost reduction limit for current vehicle lineup, Tesla focuses on further cost reductions across production stages.

Energy Storage and Solar:

- Energy storage deployments decreased in Q4 to 3.2 GWh but totaled 14.7 GWh in 2023, a 125% increase from 2022.

- The company expects continued growth in energy storage, with ramping up the 40 GWh Megafactory in Lathrop, CA.

- Solar deployments declined due to high interest rates and seasonal weaknesses, impacting profitability.

- The Services and Other business segment grew, driven by parts, used vehicle sales, merchandise sales, and supercharging.

Outlook for 2024:

- Tesla is transitioning between two major growth waves, with a possible lower vehicle volume growth rate in 2024 due to the focus on the next-generation vehicle platform.

- Energy Storage business growth is expected to outpace the Automotive business.

- The company maintains sufficient liquidity for its product roadmap and expansion plans.

- Tesla plans to continue innovating in manufacturing and operations, expecting an acceleration in AI, software, and fleet-based profits.

- Cybertruck production and deliveries will ramp up, and progress on the next-generation platform will continue.