GM Sues San Francisco Over $108M Tax on Self-Driving Unit

General Motors has initiated legal action against the city of San Francisco, contesting a $108 million tax levy imposed over a span of seven years.

The automotive giant claims the city unjustly linked the tax to a portion of its global revenue due to the presence of its Cruise self-driving unit, despite GM’s minimal operational footprint in the city, reports Bloomberg.

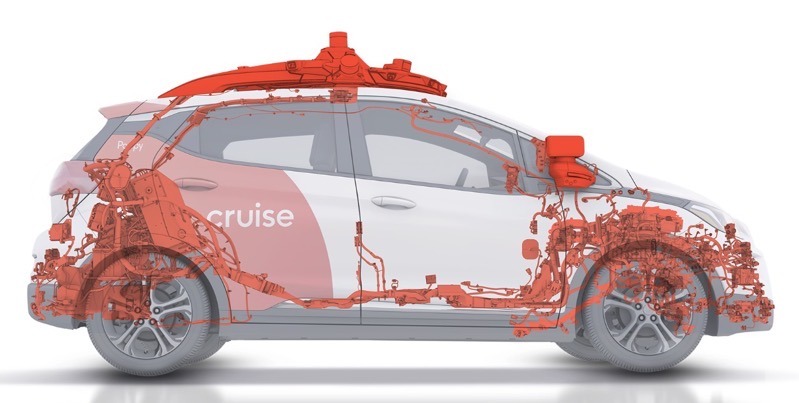

According to the lawsuit, filed last week in the California Superior Court in San Francisco (case number CGC-23-611256), GM argues that its Cruise division, specializing in autonomous vehicles, operates independently and only recently started generating notable revenue.

The Detroit-based automaker emphasizes its limited physical and commercial presence in San Francisco, citing negligible sales figures (approximately $677,000 in 2022) and the absence of dealerships, plants, or personnel in the city.

A spokesperson for the city attorney’s office in San Francisco confirmed the receipt of the complaint and stated that a formal response would be presented in court. This legal challenge surfaces amidst efforts by San Francisco’s leaders to rebrand the city as a global hub for innovation, countering the impact of urban challenges and a slow post-pandemic recovery.

General Motors contends that the tax assessment, which rendered over $3 billion of its global revenue subject to city taxes last year, contradicts California’s mandate that taxes should accurately reflect a business’s local operations. The company further criticizes the city’s method of heavily taxing based on Cruise’s payroll, noting that many Cruise employees work remotely, with some not even residing in San Francisco.

The lawsuit coincides with difficulties faced by GM, particularly the suspension of Cruise’s license to operate on public roads in California this October. The suspension followed several incidents involving Cruise’s robotaxis in San Francisco, including a crash with a fire truck and a severe accident involving a pedestrian.

In addition to challenging the tax assessment, GM seeks compensation for nearly $13 million in interest and penalties. This legal dispute has put a spotlight on the city’s gross receipts tax, which constitutes a significant portion of San Francisco’s business tax revenue, approximated at $800 million annually by the city’s comptroller in July. At this rate, GM’s contribution stands at about 2% of the city’s total tax intake.

I’m not a Cruise fan or a lawyer but GM does seem to have a point. Tax at the end not the beginning or middle.