Illinois Launches Third Round of Electric Vehicle Rebates

The State of Illinois is gearing up for its third round of electric vehicle (EV) rebates, offering significant savings for residents looking to make the switch to cleaner transportation. Starting November 1st, 2023, and continuing until January 31st, 2024, the Illinois Electric Vehicle Rebate Program will provide $4,000 off new EVs and $1,500 off electric motorcycles.

This initiative, funded by the Illinois Climate and Equitable Jobs Act, aims to promote the adoption of electric vehicles in the state. Applications for the rebates will be open from October 18th, 2023, and will be available until the allocated funds are exhausted.

Governor JB Pritzker expressed his enthusiasm for the program, stating, “Illinois is at the forefront of the clean energy movement, offering attractive incentives for both businesses and consumers. Since the inception of the Climate and Equitable Jobs Act, we’ve awarded millions in rebates to electric vehicle buyers. I’m thrilled to announce the next phase of the rebate program and urge all residents to seize this unparalleled opportunity. Our vision is to have 1 million EVs on our roads by 2030.”

The program prioritizes low-income residents, but rebates are contingent on available funding. To qualify, vehicles must be solely electric, chargeable, and road-legal. Hybrid vehicles or those with auxiliary engines are excluded.

Key eligibility criteria include:

- Illinois residency during purchase and rebate issuance.

- Purchase from an Illinois-licensed dealer.

- Exclusion of rented or leased vehicles.

- No prior rebate claims for the vehicle under this program.

- Rebate amount not exceeding the vehicle’s purchase price.

- Mandatory 12-month ownership post-purchase.

- Rebate application within 90 days of purchase.

- Necessary documentation, including purchase invoice, vehicle registration, and IRS forms.

The state’s budget has allocated $12 million for these rebates, a decrease from the previous $20 million. In addition to state rebates, buyers can also tap into federal tax credits, offering up to $7,500 for new EVs and $4,000 for used EVs priced at $25,000 or below.

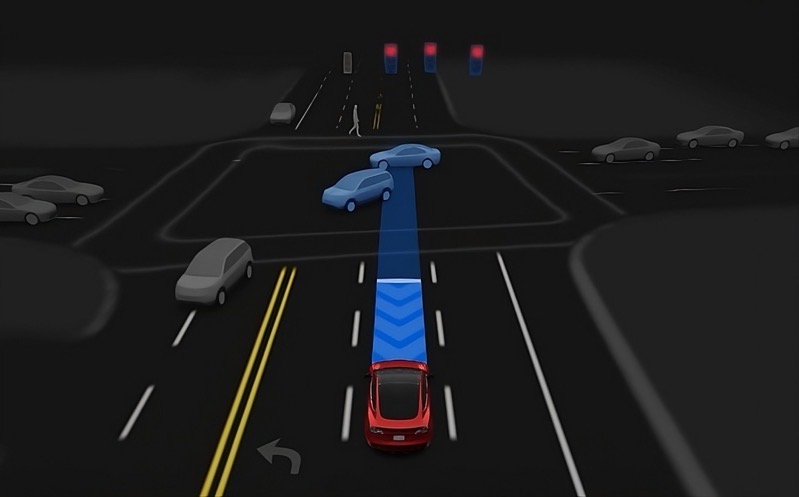

For Tesla buyers, that could mean up to $11,500 off a Model 3 or Model Y if you factor in the maximum federal tax credits as well. Buying a new Tesla through a referral also means an additional $650 off and 3 months of free Full Self-Driving.