Tesla May Earn $3 Billion from GM, Ford Charging Deals: Analyst

Tesla, under the leadership of Elon Musk, could potentially garner earnings as high as $3 billion by the end of the decade, leveraging its charging network agreements with automotive giants Ford and General Motors. The projection comes from an analysis conducted by Piper Sandler, reports Bloomberg.

The most recent agreement was announced on Thursday in a Twitter Spaces audio chat, featuring GM Chief Executive Officer Mary Barra alongside Elon Musk. This marked Barra’s inaugural appearance on the social media platform since Musk took over Twitter last year. Similarly, Ford CEO Jim Farley unveiled its agreement with Tesla in May.

These partnerships position Tesla’s charging model as the standard among the largest American automakers, consequently putting pressure on competitors to abandon the main competing standard, known as CCS.

Alex Potter, an analyst at Piper Sandler, stated in a research note on Friday, “Other brands will be compelled to join this consortium, effectively establishing Tesla’s ‘North American Charging Standard’ as the preferred method for EV charging — predominantly in the United States.”

Although the companies have not disclosed revenue specifics, Piper Sandler’s estimations suggest that by 2030, Tesla could see an addition of over $3 billion in charging revenue solely from non-Tesla owners, which could surge to $5.4 billion by 2032.

Shares of Tesla surged on Friday, currently up 4.96% at $246.50 per share as part of a rally this week. GM shares are up 2.27% at $36.66 per share.

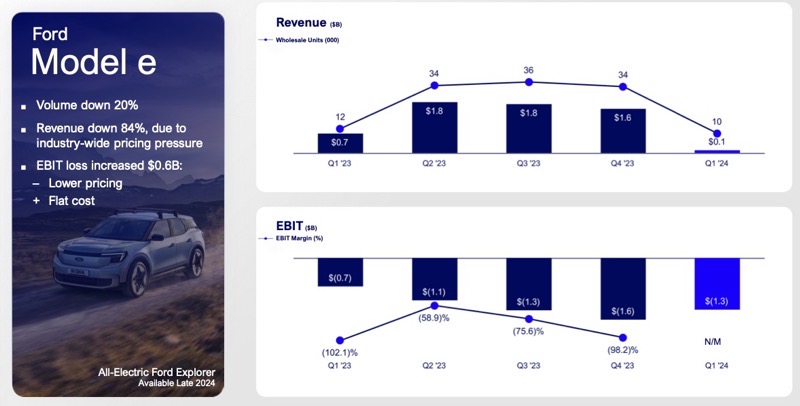

Even though Tesla already has an annual revenue surpassing $80 billion, this windfall could have significant implications. With GM and Ford racing to keep up in the EV sector, while struggling with non-profitable EV programs, the added income from their customers could impact their margins. The additional charging revenue is expected to bolster Tesla’s finances, just as its sales of zero-emission regulatory credits to legacy automakers did over the past decade.

However, the announcement of Tesla’s agreement with GM saw a downturn in competing charging companies. Shares of EVgo Inc., which had recently formed a partnership with GM for building charging stations, and ChargePoint Holdings Inc., each plummeted by 10%.