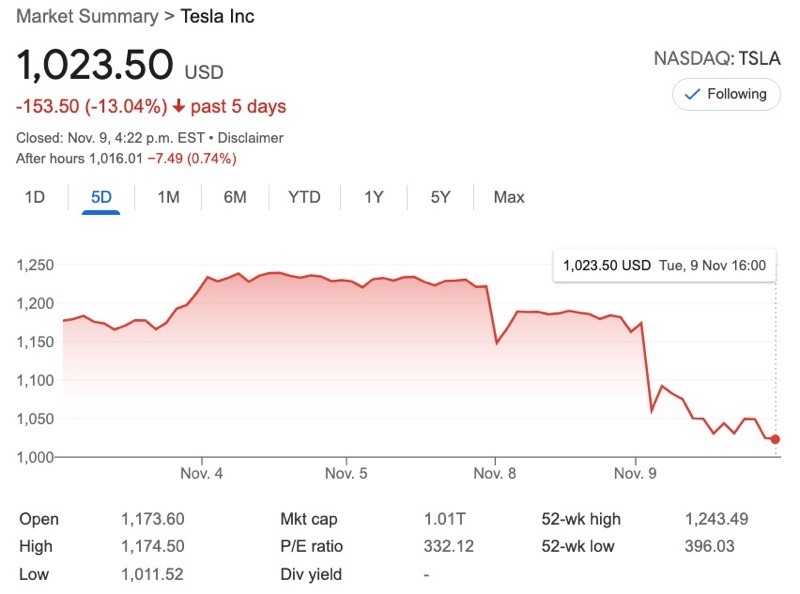

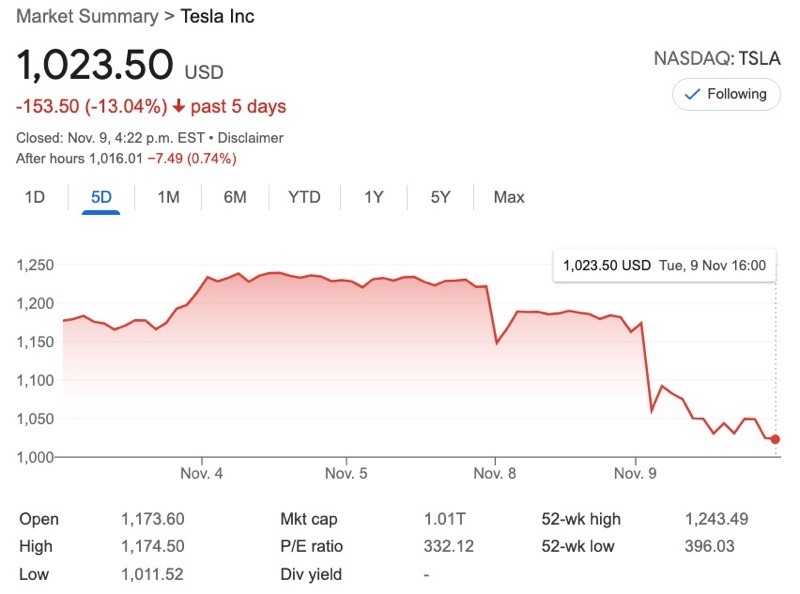

After rolling up 29% for the past month, shares of Tesla have come falling back down, as the stock has dipped 16% over the past two days.

After closing Friday at $1,221 per share, Tesla’s stock price has come tumbling down to $1,023.50 at the end of Tuesday’s trading sessions. That’s a 16% drop over two days, one of the biggest drops of the year for the company, whose market cap now stands at $1.01 trillion.

Tesla’s stock price coming down comes after CEO Elon Musk proposed selling 10% of his stock, a poll he asked his followers on Twitter. Musk said he was prepared to follow the outcome of the poll, which saw 3.5 million votes with 57.9% favouring ‘yes’, for the CEO to sell some of his stock.

https://teslanorth.com/2021/11/06/elon-musks-twitter-poll-asks-if-he-should-sell-10-of-his-stock/

According to CNBC, Musk has stock options expiring in August 2022, and his expected purchase comes with a huge tax bill of $15 billion, after taking state and federal taxes into consideration. In order to pay the tax bill, Musk will need to sell some of his stock to get cash, as the CEO takes no salary from Tesla or SpaceX.

Other articles in the category: Tesla

Tesla Officially Kills $8,000 FSD One-Time Purchase in U.S.

After more than nine years of offering Full Self-Driving (FSD) as a one-time software purchase, Tesla has officially pulled the plug on the upfront option in North America. As expected, the previous $8,000 one-time FSD purchase — available either when ordering a vehicle or after delivery — is no longer available in the U.S. Going […]

Tesla Replaces Coal: $330M Battery Goes Live in Australia

A new grid-scale battery powered by Tesla Megapacks is now officially online in Queensland, Australia, marking another major milestone for the company’s fast-growing energy storage business. As first reported by Energy-Storage.News, publicly owned energy company CleanCo Queensland has opened the Swanbank Battery Energy Storage System (BESS), a 250 MW/500 MWh facility located at the former […]

Tesla Launches $450 Mezcal: 50 Lucky Buyers Get Signed Boxes

Tesla is back in the spirits game — this time with a design-forward twist. The company has quietly launched a new Tesla Mezcal | Design Studio Edition in the U.S., priced at $450. The limited-run bottle leans heavily into Tesla’s design ethos, complete with a specially crafted box sleeve that features early sketches of the […]