Tesla Investor Sues Elon Musk, Claims Tweets Violate SEC Settlement

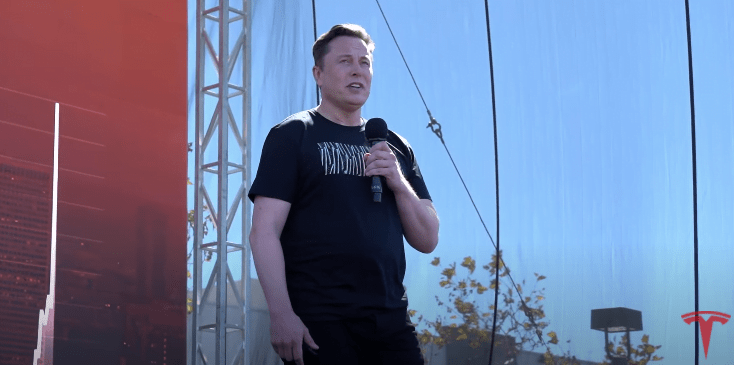

In a lawsuit filed in the Delaware Chancery Court on March 8 and made public yesterday, one of Tesla’s investors has sued the company’s board and CEO Elon Musk for the latter’s “erratic” tweets and behavior online — reports Bloomberg Law.

The lawsuit claims that Musk has violated an agreement with the U.S. Securities and Exchange Commission (SEC) that requires pre-approval of all of his social media activity, and that his tweets have already cost the company billions in market capitalization and potential liability.

From suggesting Tesla shares were overpriced (which “destroyed almost $14 billion of Tesla’s market capitalization in a single day” according to the lawsuit) to causing a surge in Bitcoin prices by simply adding the word to his Twitter bio, the influence of Musk’s online activity is well established.

$TSLA CEO and its Board were sued in Delaware Chancery court by a private investor over Elon’s “erratic” tweets, and for the Board’s failure to rein him in. Investors can sue for anything (could be a short). This is different from the SEC going after Elon. It’s irrelevant. pic.twitter.com/mLf1vQp3X8

— Gary Black (@garyblack00) March 12, 2021

Musk had previously been reprimanded for his actions online in a 2018 settlement with the SEC, as part of which both the CEO and Tesla’s board had to pay $20 million USD each, and the board had to agree to overseeing and more sternly regulating Musk’s activity online.

The lawsuit alleges that the CEO has “continued to issue tweets without the required pre-approval”, and that “Musk’s wrongful conduct” and “the failure of Tesla’s board to ensure compliance” have “caused substantial damage” to the automaker.

“Further unchecked tweeting by Musk” could “have severe ramifications on the company’s ability to secure financing”, and it “drives out the very voices in the company meant to stand up to him and protect” investors, says the lawsuit.