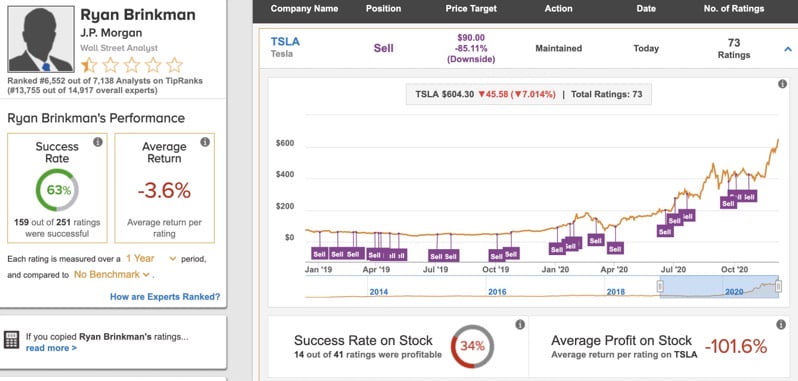

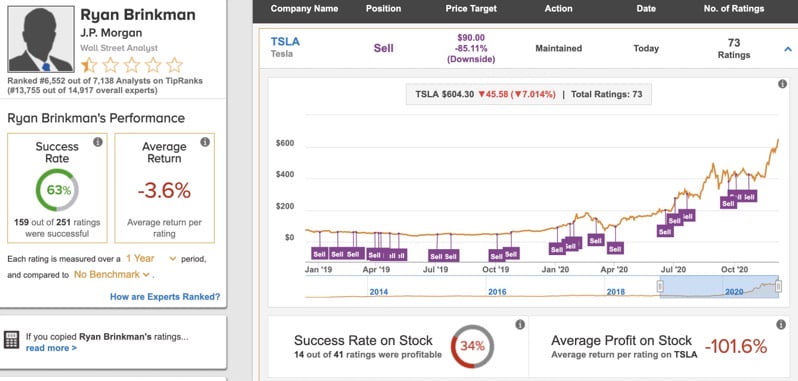

According to JPMorgan Ryan Brinkman, he believes Tesla’s stock price is now “dramatically” overvalued.

In a research note published Wednesday, Brinkman, who is bearish on Tesla, also said it’s a mistake for investors to increase holdings of the electric automaker ahead of the S&P 500 inclusion.

Bloomberg reports Brinkman said Tesla’s meteoric rise is “strongly suggestive of the idea that something apart from the fundamentals (speculative fervor?) is driving the shares higher.”

The JPMorgan analyst’s price target for Tesla was raised from $80 to $90, despite the stock trading as high as $650 per share on Tuesday. As of writing, Tesla is down and trading at $591 per share.

Bloomberg says its data shows “Brinkman’s recommendation received a negative 867% return in the past year.” Ouch.

As you can see from the screenshot above from Tip Ranks, Brinkman isn’t doing too well as an analyst for JPMorgan at the moment.

Other articles in the category: Tesla

Tesla Officially Kills $8,000 FSD One-Time Purchase in U.S.

After more than nine years of offering Full Self-Driving (FSD) as a one-time software purchase, Tesla has officially pulled the plug on the upfront option in North America. As expected, the previous $8,000 one-time FSD purchase — available either when ordering a vehicle or after delivery — is no longer available in the U.S. Going […]

Tesla Replaces Coal: $330M Battery Goes Live in Australia

A new grid-scale battery powered by Tesla Megapacks is now officially online in Queensland, Australia, marking another major milestone for the company’s fast-growing energy storage business. As first reported by Energy-Storage.News, publicly owned energy company CleanCo Queensland has opened the Swanbank Battery Energy Storage System (BESS), a 250 MW/500 MWh facility located at the former […]

Tesla Launches $450 Mezcal: 50 Lucky Buyers Get Signed Boxes

Tesla is back in the spirits game — this time with a design-forward twist. The company has quietly launched a new Tesla Mezcal | Design Studio Edition in the U.S., priced at $450. The limited-run bottle leans heavily into Tesla’s design ethos, complete with a specially crafted box sleeve that features early sketches of the […]